The 50/30/20 Rule in 2025: Still Relevant or Outdated?

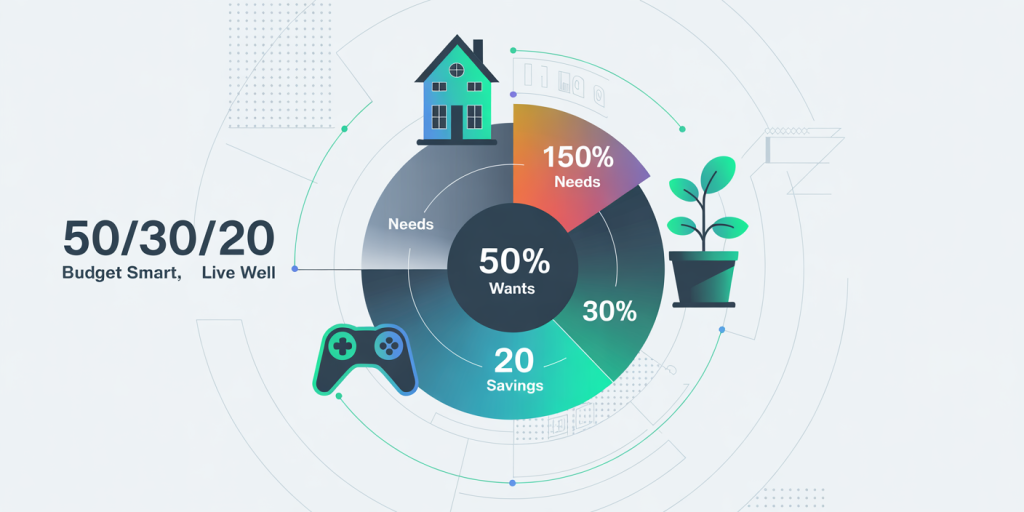

In an age where personal finance strategies continually evolve, the 50/30/20 budgeting rule has remained one of the most popular guidelines for managing individual budgets since its introduction by Senator Elizabeth Warren. This straightforward rule suggests allocating 50% of after-tax income to needs, 30% to wants, and 20% to savings and debt repayments. However, with rapid economic shifts, inflation fluctuations, rising living costs, and changing mindset about money management in 2025, many wonder: Is the 50/30/20 rule still a relevant and effective budgeting strategy?

This article examines the accuracy and applicability of the 50/30/20 rule in today’s economic climate. By analyzing current data, practical examples, and comparing alternative budgeting approaches, we provide a comprehensive outlook on whether this rule holds its ground or demands significant adjustments for the modern earner.

—

The 50/30/20 Rule: A Recap of Its Foundations

The 50/30/20 rule, introduced in Elizabeth Warren’s book *All Your Worth*, was designed to simplify how individuals approach their finances by giving a balanced allocation that covers essentials, lifestyle, and future financial security. The “needs” category includes housing, utilities, groceries, transportation, and other essential expenses. “Wants” cover discretionary spending like dining out, entertainment, shopping, and hobbies. The “savings” segment emphasizes emergency funds, retirement contributions, and debt payments.

This structured model aimed to create financial discipline without sacrificing lifestyle flexibility. At its core, it encouraged people to save adequately while enjoying life, rather than following rigid or complex budget plans.

Recent surveys from Deloitte (2024) indicate that nearly 60% of Americans are either unaware of the 50/30/20 rule or fail to follow a formal budgeting strategy altogether. The rule’s simplicity is a key strength, but it raises the question – does this simplicity still match today’s multifaceted financial challenges?

—

Economic Shifts Impacting Budgeting in 2025

Since the early 2020s, global economies experienced significant inflationary pressures. In the U.S., inflation averaged 6.5% annually between 2021 and 2023, which greatly impacted the cost of essential goods and services. Housing costs, in particular, surged over 20% in major cities like New York, Los Angeles, and Chicago, according to the U.S. Bureau of Labor Statistics (BLS, 2024).

This surge means that for many households, the 50% allocation to “needs” no longer suffices to cover all necessary expenses comfortably. For example, renters in urban areas often spend more than 35-40% of their income on housing alone, which compromises their flexibility in other budget areas.

Furthermore, wage growth has been sluggish when adjusted for inflation, leading to tighter disposable incomes. A Pew Research Center study (2024) shows that median wage growth barely kept pace with inflation, forcing many Americans to prioritize needs over wants or savings.

Therefore, an important question emerges: should “needs” absorb a larger share of income at the expense of “wants” and savings? Or, alternatively, are there other factors to consider in reshaping budget allocations?

—

Practical Case Study: Budgeting for a Middle-Income Family in 2025

Consider a middle-income family living in Atlanta, Georgia, with a combined monthly after-tax income of $5,000. Using the 50/30/20 rule, their budget would roughly break down as:

| Category | Amount (USD) | Description |

|---|---|---|

| Needs (50%) | $2,500 | Rent, groceries, utility bills |

| Wants (30%) | $1,500 | Entertainment, dining, travel |

| Savings (20%) | $1,000 | Retirement, emergency fund |

However, in practice, this family’s rent alone amounts to $1,800 monthly, and utility bills and groceries add another $1,000, totaling $2,800. This already exceeds the recommended 50% spending limit on needs.

To adjust, the family reduces wants to 20%, limiting discretionary spending to $1,000, and savings to 30% ($1,500), focusing more on debt repayment and retirement contributions—an inversion of the original model.

This example highlights how real-life circumstances, especially regional cost differences and financial priorities, necessitate flexibility beyond the fixed 50/30/20 proportions.

—

Comparing 50/30/20 with Alternative Budgeting Rules

Several alternative budgeting methods have emerged or gained traction recently, offering different approaches to balance spending and saving. Table 1 compares the 50/30/20 rule with two popular alternatives in 2025—Zero-Based Budgeting and the 70/20/10 Rule.

| Budgeting Method | Needs Allocation | Wants Allocation | Savings Allocation | Key Characteristics |

|---|---|---|---|---|

| 50/30/20 Rule | 50% | 30% | 20% | Simple, balanced, encourages saving and enjoyment |

| Zero-Based Budgeting | Variable | Variable | Variable | Every dollar is assigned a purpose, maximizes control |

| 70/20/10 Rule | 70% | 20% | 10% | Prioritizes essential expenses, minimal savings |

The Zero-Based Budgeting method is highly customized and potentially more effective when income is irregular or when strict financial goals exist, such as paying off debt rapidly or saving for a major purchase. However, it requires more effort and detailed record-keeping.

The 70/20/10 rule, sometimes seen in higher-cost living situations, acknowledges that essential expenses may consume a larger income share. This method prioritizes needs (70%), provides moderate wants (20%), and limits savings to 10%, which may not be ideal but reflects practical constraints.

Ultimately, the choice depends on individual circumstances rather than a one-size-fits-all formula.

—

The Role of Technology and Financial Tools in Applying Budget Rules

One significant transformation in personal finance over recent years is the widespread adoption of digital financial tools, apps, and services. From AI-powered budgeting apps like YNAB (You Need A Budget) and Mint to robo-advisors offering personalized savings goals, technology has facilitated customized adherence and real-time monitoring of budgets.

In 2025, integration of artificial intelligence and behavioral analytics provides more precise feedback and adaptive budget adjustments than ever before. For example, AI tools can analyze spending trends and alert users when an allocation in “needs” or “wants” exceeds historical norms or when more funds should be directed towards debt.

This technological progress makes it easier to apply the 50/30/20 rule flexibly. Users can modify percentages, receive actionable advice, and visualize the trade-offs between discretionary spending and savings in real time. As a result, the rigid adherence to the fixed percentages becomes less crucial than using the rule as a guiding framework supported by data-driven insights.

—

Can 50/30/20 Be Personalized? Insights from Financial Experts

Financial advisors increasingly advocate customizing budget frameworks based on individual life stages, goals, and macroeconomic conditions. According to a 2024 survey by the CFP Board, 72% of certified financial planners recommend modifying the 50/30/20 rule for clients experiencing major life changes such as starting a family, career transitions, or planning retirement.

For instance, younger adults in their 20s might want to allocate a larger portion of income to “wants” to maintain lifestyle experiences, while simultaneously accelerating “savings” for retirement via high-yield investment options. Conversely, retirees may focus heavily on “needs,” particularly healthcare, while scaling back “wants” and reducing traditional savings.

Personal stories highlight this flexibility. Rachel, a 34-year-old software developer in Seattle, shared that she adjusted her allocation to 40/25/35. She found that with remote work options, her transportation and work-related expenses decreased, allowing her to funnel more income into aggressive savings and debt repayment.

Another example, Carlos, a 45-year-old entrepreneur, oscillates between 55/20/25 depending on business income fluctuations. This adaptability demonstrates that while the 50/30/20 rule is foundational, the nuanced allocation tailored to people’s realities improves financial health.

—

Future Perspectives: Will 50/30/20 Persist Beyond 2025?

Looking ahead, the relevance of the 50/30/20 rule will likely depend on continued economic trends, technology integration, and cultural shifts in money management. Inflationary cycles, housing affordability crises, and changes in employment models (gig economy, remote work) all challenge traditional budgeting templates.

However, financial literacy initiatives and technology tools promise to keep the core principles of the 50/30/20 rule alive—balance, simplicity, and pragmatism. Emerging methods could blend behavioral economics with AI-driven nudges, creating hybrid models that personalize spend-save ratios dynamically.

Additionally, as younger generations prioritizing financial wellness adopt smarter tools, we may see a move towards flexible budgeting rules that adjust monthly or quarterly to reflect real-time circumstances rather than fixed annual plans.

Ultimately, the future may not see the 50/30/20 rule as a strict directive but as a critical educational foundation—an adaptable framework that consumers and advisors personalize to maintain financial stability, achieve goals, and enjoy life.

—

The 50/30/20 rule, despite evolving socio-economic factors, has maintained relevance as a foundational budgeting tool. The increases in living expenses since its inception have urged many to revisit and adjust its proportions without discarding its core premise. With technological advancements and personalized financial advice becoming more prevalent, the rule’s flexibility and adaptability will determine its continued utility in 2025 and beyond. For both beginners and seasoned budgeters, understanding the spirit behind the 50/30/20 rule and tailoring it with data-backed strategies remains the smartest approach to financial health.