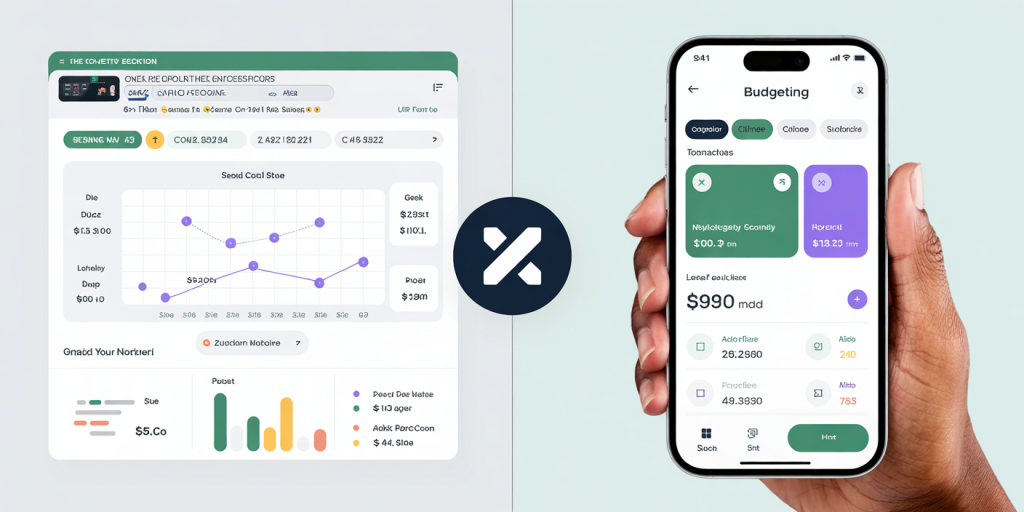

Spreadsheets vs Apps: What’s Better for Budgeting?

In today’s digitally driven world, managing personal finances has become increasingly accessible yet complex. Budgeting, a fundamental aspect of financial health, can be approached through various tools, notably spreadsheets and dedicated budgeting apps. Each method offers distinct advantages and challenges, appealing to different budgeting styles and needs. This article delves into the core differences between spreadsheets and apps, analyzing their features, usability, and effectiveness through practical examples and data-driven insights.

The Growing Importance of Budgeting Tools

Budgeting has transitioned from being a cumbersome paper-based task to a streamlined process leveraging modern technology. According to a 2023 survey by the National Endowment for Financial Education (NEFE), nearly 62% of Americans use some form of digital tool for money management, with apps gaining significant traction. However, spreadsheets remain popular, especially among those who prefer customization and granular control.

Why is this shift significant? Financial literacy has direct effects on economic stability, and with rising inflation affecting households globally, the need for reliable budgeting tools is paramount. Whether you are an individual tracking monthly expenses or a small business owner managing cash flow, choosing the right tool affects your overall financial clarity and success.

Customization and Flexibility: The Strength of Spreadsheets

Spreadsheets, particularly those created using Microsoft Excel or Google Sheets, offer unparalleled flexibility. Users can design budgets tailored to their unique financial situations without being confined to preset categories or rules. For example, someone juggling multiple income streams—such as freelance work, investments, and a salaried job—can create a multi-tiered tracking system that a typical app might not support natively.

Moreover, spreadsheets support complex formulas, pivot tables, and conditional formatting to provide dynamic visualizations of income versus expenses. This empowers advanced users to forecast spending patterns over months or years, assess loan repayments, or simulate savings growth. For instance, a freelance graphic designer might set up a spreadsheet to adjust tax deductions seasonally, which a generalized budget app could struggle to handle effectively.

However, the customization comes with trade-offs: spreadsheets require a steep learning curve and consistent manual input. Unlike apps that often automate data entry via bank linkages, spreadsheet users must enter transactions or import data files. This manual process increases the chance of human error but can also reinforce financial mindfulness through active engagement.

User Experience and Automation: The Case for Budgeting Apps

Budgeting apps such as Mint, YNAB (You Need A Budget), and PocketGuard have revolutionized how people manage their money by automating mundane tasks. These apps often connect directly with bank accounts, credit cards, and loan services to update transactions in real-time, drastically reducing the effort needed for budget maintenance.

For example, YNAB’s philosophy emphasizes proactive planning with features that encourage users to assign every dollar a job before spending. Mint, on the other hand, provides an overview that automatically categorizes expenses, sending alerts about overspending in certain categories or upcoming bills. According to a 2022 poll by Statista, 40% of respondents preferred apps with automated transaction tracking over manual methods, underscoring the value of this convenience.

Ease of use is a significant selling point. Apps typically feature intuitive interfaces, mobile accessibility, and goal-setting tools that support consistent budgeting habits. For instance, a busy professional might find that an app’s push notifications help stay on track without the time commitment spreadsheets demand. Yet, apps usually lack the degree of customization that spreadsheets offer and may impose subscription fees for premium features.

Security and Privacy Concerns

When choosing between spreadsheets and budgeting apps, security plays a crucial role. Spreadsheets stored locally or in secure cloud services controlled by users provide a level of privacy that budgeting apps, which often require access to financial accounts, cannot guarantee entirely.

Spreadsheets allow users to keep financial data offline, reducing vulnerability to hacking risks. In contrast, apps must comply with regulations such as the Payment Card Industry Data Security Standard (PCI DSS), but incidents of data breaches still occur. In 2023, a major security firm reported that over 15 million personal finance app users experienced data exposure during breaches across various service providers.

Despite this, many budgeting apps employ advanced encryption and two-factor authentication, significantly mitigating risks. The trade-off often comes down to convenience versus control—the user must balance ease of access with how much sensitive information they are willing to share and store on third-party servers.

| Aspect | Spreadsheets | Budgeting Apps |

|---|---|---|

| Customization | Highly customizable | Limited by app design |

| Automation | Manual input required | Automatic transaction syncing |

| User Experience | Requires knowledge of software | User-friendly, guided workflow |

| Security | Data control lies with user | Relies on app provider’s security |

| Cost | Usually free or one-time purchase | Often subscription-based |

| Accessibility | Desktop and cloud-based versions | Mobile-first, cross-device syncing |

Real-World Cases: What Users Prefer and Why

A recent case study by the Financial Health Network analyzed 1,200 budget tool users between 2021 and 2023. Among respondents using spreadsheets, 70% were self-employed or working in fields with irregular income. Their feedback emphasized the ability to build personalized categories, track fluctuating incomes, and avoid paying for multiple app subscriptions. Additionally, advanced Excel users reported enhancing their budget spreadsheets with macros and custom charts for detailed monthly reporting.

Conversely, among app users, 65% were salaried employees and younger professionals aged 25 to 35. Their priorities centered around ease of use, quick setup, and automation features. Many cited the ability to receive reminders, link multiple bank accounts, and visualize spending trends as crucial benefits. Several users also highlighted that apps with integrated savings challenges help cultivate better money habits, a feature impossible to replicate exactly in spreadsheets without additional tools.

One hybrid strategy gaining traction is the use of apps for day-to-day tracking combined with monthly exporting of data to spreadsheets for deep analysis. This approach leverages the strengths of both, ensuring convenience without sacrificing detailed insight.

Cost Efficiency and Long-Term Maintenance

Budgeting solutions also differ in cost structure. Most spreadsheet programs are available at low or no cost—Google Sheets is freely accessible online, while Microsoft Excel may come included with office packages. In contrast, budgeting apps often operate on freemium models, offering basic features free but charging for premium services like investment tracking, debt payoff calculators, or advanced reports.

For instance, the premium version of YNAB costs approximately $14.99 per month, or $99 annually. Mint, while free, incorporates advertisements and offers paid upgrades for credit monitoring and identity protection services. Over time, these fees can add up, making spreadsheets a more economical option, especially for users comfortable with handling their own data.

Maintenance is also a factor: spreadsheets demand consistent manual updating but do not rely on external servers or subscription renewals. Conversely, apps require ongoing payments if users want uninterrupted access to premium functionality, and service outages or app shutdowns can abruptly affect budget tracking.

Emerging Trends and Future Perspectives in Budgeting Technology

As artificial intelligence (AI) and machine learning technologies evolve, budgeting tools are poised to become smarter and more intuitive. Apps are beginning to offer predictive analytics, personalized spending advice, and even automated saving suggestions based on user behavior. For example, upcoming features in apps like PocketGuard leverage AI to forecast less obvious expenses and suggest ways to optimize spending.

Meanwhile, spreadsheets are benefiting from integration with automation platforms like Zapier and Power Automate, enabling semi-automated data entry and real-time financial data pulls. Templates incorporating AI-powered formulas and financial modeling are increasingly available, helping bridge the gap between the customization offered by spreadsheets and automation from apps.

Hybrid models blending these technologies may become the norm, where users enjoy the flexibility of custom spreadsheets without sacrificing automation and insights from apps. Cloud-based spreadsheet environments will enhance collaboration with financial advisors or family members, expanding budgeting’s scope beyond personal use.

In addition, privacy-centric budgeting apps harnessing blockchain and decentralized finance (DeFi) models may emerge, addressing current security concerns while maintaining ease of use. These innovations could redefine budgeting tools in the coming decade, making financial management smarter, safer, and more personalized.

—

In sum, the choice between spreadsheets and budgeting apps depends largely on individual preferences, financial complexity, and priorities such as customization, automation, cost, and security. While spreadsheets appeal to users seeking control and detailed analysis, apps offer convenience and guidance for those seeking to automate and simplify money management. Understanding these trade-offs and leveraging hybrid solutions can empower users to develop budgets that truly enhance their financial well-being.