What Are Index Funds and Why They’re a Game-Changer

Index funds have revolutionized the investment landscape by offering a simple, cost-effective, and efficient way for individuals and institutions to grow wealth. Their growing popularity over recent decades stems from their ability to provide broad market exposure while minimizing typical downsides of active management. This article explores what index funds are, why they matter, and how they continue to reshape the world of investing, supported by real-world examples, market data, and future outlooks.

Understanding the Basics of Index Funds

An index fund is a type of mutual fund or exchange-traded fund (ETF) designed to replicate the performance of a specific financial market index, such as the S&P 500, Dow Jones Industrial Average, or NASDAQ 100. Instead of relying on a fund manager to select stocks based on market timing or individual company valuations, index funds simply hold all (or a representative sample) of the securities within the chosen index in the same proportion.

For example, an S&P 500 index fund invests in the 500 largest public companies in the United States, mirroring their weightings in the index. This means investors effectively own a slice of the U.S. economy diversified across sectors such as technology, healthcare, financials, and consumer goods. This strategy greatly reduces the risks associated with individual stock picking and timing market cycles.

The concept dates back to the 1970s when economist John Bogle founded Vanguard Group and launched the first index fund for individual investors. Since that time, index funds have grown enormously in assets under management (AUM), reaching over $13 trillion globally as of 2023, according to Morningstar data.

Cost Efficiency: A Key Advantage Over Actively Managed Funds

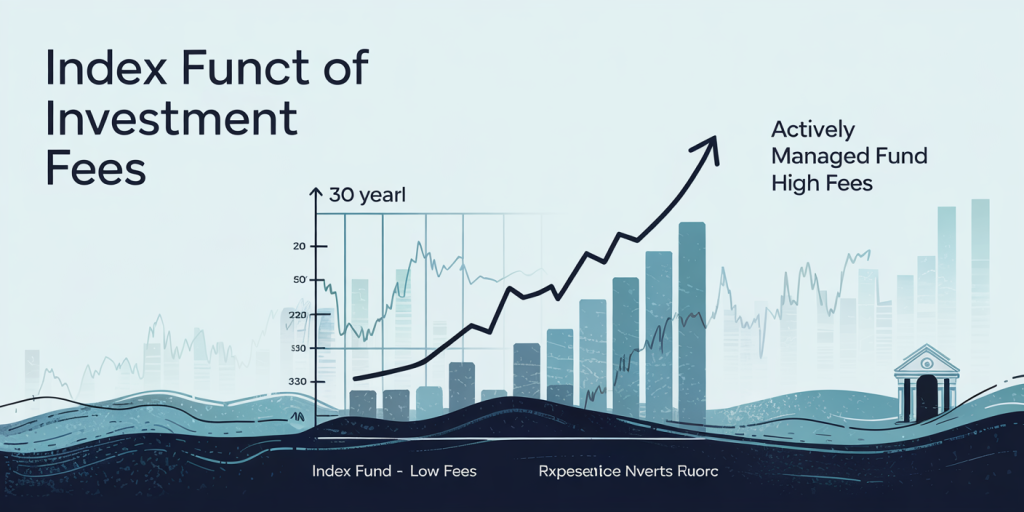

One of the most significant benefits of index funds is their lower expense ratios compared to actively managed mutual funds. Active funds employ teams of analysts and portfolio managers to research and trade securities in an attempt to outperform the market. This intensive management results in higher operating costs, which are passed onto investors.

In contrast, index funds require minimal intervention since they only track the performance of an established index. This dramatically reduces operational and management costs. According to a 2022 report from the Investment Company Institute, the average expense ratio for actively managed equity funds was 0.74%, while the average expense ratio for index equity funds was just 0.08%. Over time, these cost savings can create substantial differences in investor returns due to the compounding effect of fees.

To illustrate, imagine an investor puts $10,000 into two funds with a 7% annual return. After 30 years, the index fund with a 0.08% fee grows to approximately $76,122, whereas the actively managed fund with a 0.74% fee grows to around $58,699. That’s a difference of over $17,000 attributable solely to fees.

| Fund Type | Average Expense Ratio | Value After 30 Years (Starting $10,000) |

|---|---|---|

| Index Fund | 0.08% | $76,122 |

| Actively Managed Fund | 0.74% | $58,699 |

Real Case: Vanguard 500 Index Fund

The Vanguard 500 Index Fund, one of the largest and oldest index funds, charges an expense ratio of just 0.04%, significantly less than many actively managed funds that can charge between 0.7% and 1.5%. This fund’s cost efficiency has attracted millions of investors worldwide, helping it amass over $750 billion in assets.

Performance and Risk: Why Index Funds Often Outperform Active Management

For decades, numerous studies have shown that most actively managed funds fail to outperform their benchmark indices over long periods. According to the SPIVA (S&P Indices Versus Active) U.S. Scorecard 2023, about 85% of actively managed large-cap funds underperformed the S&P 500 benchmark over the past 10 years. This underperformance is often due to higher fees, management errors, and the difficulty of consistently predicting market movements.

By design, index funds replicate market returns, which historically average around 7-10% annually, depending on the time frame and specific index. The consistent performance and diversification of index funds can reduce unsystematic risk – the risk associated with individual companies – by spreading investments across hundreds or thousands of securities.

For example, an investor in the Fidelity Contrafund, an actively managed fund, might see varied results based on the manager’s stock selections. Meanwhile, the iShares Core S&P 500 ETF, representing the same index, delivers returns that mirror the overall market without the risk of picking wrong stocks.

Comparative Table: Return Comparison Over 10 Years (2013-2023)

| Fund Type | Average Annual Return | Percentage of Active Funds Outperformed |

|---|---|---|

| S&P 500 Index Fund | 9.3% | 85% |

| Average Actively Managed Fund | 7.1% | – |

Accessibility and Transparency: Making Investing Simple

Another game-changing aspect of index funds is their accessibility. Traditional investing often involved substantial minimum investments, specialized knowledge, and complex decision-making processes. Index funds, on the other hand, allow everyday investors to buy shares through retirement accounts (401(k)s, IRAs), brokerage accounts, or even employer-sponsored plans with low minimum investments.

Moreover, index funds provide transparency through regular reporting that clearly shows the fund’s holdings, expense ratios, and performance relative to benchmarks. This transparency builds trust and helps investors avoid hidden fees or opaque management strategies sometimes found in actively managed funds.

Take the case of Charles Schwab’s U.S. Broad Market ETF (SCHB) — with an expense ratio of just 0.03%, it tracks an index of over 2,500 U.S. stocks, giving investors broad diversification and exposure to the full market at a very low cost, available with no trading commissions through many online platforms.

Tax Efficiency: Enhancing Net Returns

Index funds also offer tax advantages compared to actively managed funds. Because index funds have lower portfolio turnover — they buy and sell securities only when the underlying index changes — they generate fewer capital gains distributions, which are taxable to the investor.

In contrast, active funds often buy and sell frequently to try and beat the market, leading to higher short-term capital gains taxes. For investors in taxable accounts, this means actively managed funds often result in a higher tax burden, reducing net returns.

According to a 2021 study by Morningstar, index funds distributed an average of 0.3% in capital gains annually, while active funds distributed roughly 2.6%. Over time, this tax inefficiency can lower after-tax returns significantly.

Practical Example

Consider two investors investing $50,000 each in index and active funds generating the same pre-tax return of 8%. Because the active fund results in more frequent capital gains, the after-tax return might be closer to 6.8% depending on the tax bracket, while the index fund’s after-tax return could remain near 7.8%. Over 20 years, this 1% difference can lead to tens of thousands of dollars in additional wealth for the index fund investor.

The Future of Investing: Index Funds and Beyond

The rise of index funds has been one of the most transformative trends in the investment industry, and their influence continues to grow. As of 2024, index mutual funds and ETFs account for nearly 50% of total U.S. equity fund assets, a proportion that continues to rise as investor preferences shift towards passive strategies.

Technological advances in trading platforms, robo-advisors, and fintech applications have further democratized access to index funds. Digital platforms such as Betterment and Wealthfront rely heavily on low-cost index ETFs to build diversified portfolios for users automatically, reducing barriers to entry for novice investors.

Looking ahead, we expect index funds to evolve with innovations like smart beta and factor-based indexing, which blend passive indexing with strategic adjustments to target specific investment factors such as value, momentum, or quality. These products aim to enhance returns without the full risks or high costs of active management.

Furthermore, environmental, social, and governance (ESG) focused index funds are gaining traction. Investors increasingly demand funds that track indices incorporating ESG criteria, allowing them to align their investments with their values without sacrificing diversification or cost efficiency.

Challenges and Considerations

Despite their advantages, index funds are not without challenges. Critics point out that the growing dominance of passive indexing may lead to distorted market dynamics, where stock prices become tethered too closely to index weightings rather than fundamentals. Additionally, concentrated exposure to large-cap stocks within popular indices could increase systemic risks if market conditions deteriorate.

Investors should also be careful to choose index funds that track diversified and liquid indices, rather than niche or highly specialized ones with limited trading volume or higher tracking errors.

—

In summary, index funds represent a paradigm shift in investment strategies by combining simplicity, low cost, transparency, and consistent market returns. For individual investors seeking long-term wealth accumulation, they offer a pragmatic and powerful alternative to active management. As innovation and investor demand continue to evolve, index funds are poised to remain at the forefront of portfolio construction well into the future.