Dividend Investing for Passive Income: A Beginner’s Guide

Dividend investing has become an increasingly popular strategy among investors seeking reliable, passive income streams. Unlike growth investing, which prioritizes capital appreciation through rising stock prices, dividend investing focuses on generating regular cash flow from dividend payments. This approach can provide financial stability, portfolio diversification, and compounding growth over time. For beginners eager to build wealth while minimizing active management, understanding dividend investing fundamentals is crucial.

Dividend investing is especially appealing in today’s low-interest-rate environment where traditional savings accounts and bonds offer meager returns. According to a 2023 report by Fidelity, dividend-paying stocks historically account for more than 40% of total US stock market returns, highlighting their significance in wealth generation. This guide offers a comprehensive overview of dividend investing, practical tips, real-life examples, and insights into future trends shaping this investment style.

—

Understanding Dividend Investing: What It Is and Why It Matters

Dividend investing revolves around purchasing shares in companies that distribute a portion of their earnings back to shareholders in the form of dividends. These payments usually occur quarterly and provide investors with a steady income stream without selling their shares. Companies that pay dividends are often mature, financially stable, and generate consistent cash flow, making them attractive for risk-averse investors.

One of the key benefits of dividend investing is the concept of compounding returns. Reinvested dividends can be used to buy additional shares, which in turn generate more dividends, accelerating portfolio growth over time. For example, Warren Buffett’s Berkshire Hathaway famously grows investor value not just through stock appreciation, but also through dividends reinvested in quality businesses. The compounding effect is a critical component for passive income generation, enabling investors to build wealth steadily and sustainably.

Dividend yields and payout ratios are essential metrics for evaluating dividend stocks. The dividend yield is the annual dividend payment divided by the stock price, indicating the percentage return from dividends alone. Payout ratio, calculated as dividends divided by earnings, shows how sustainable a company’s dividend is. For example, a company paying a 4% yield with a payout ratio of 50% is generally considered financially healthy in returning income to shareholders without compromising growth.

—

Choosing the Right Dividend Stocks: Key Criteria and Strategies

Investors must carefully select dividend stocks to balance income potential with financial safety. High yields are attractive but may signal underlying problems such as declining earnings or imminent dividend cuts. On the other hand, too conservative a yield might lead to minimal income growth. Hence, quality metrics beyond yield must guide decisions.

A widely used strategy is to target “Dividend Aristocrats,” a group of companies in the S&P 500 that have increased their dividends annually for at least 25 consecutive years. These firms, including well-known names like Coca-Cola, Johnson & Johnson, and Procter & Gamble, demonstrate resilience through economic cycles. Their consistent dividend growth often outpaces inflation, preserving purchasing power for investors.

Practical examples reveal key attributes to seek: Stable earnings and cash flow: Companies with predictable earnings can maintain dividend payments even during downturns. Low payout ratios: A payout ratio below 60% often indicates room for dividend increases without risking financial stress. Strong balance sheets: Low debt levels reduce bankruptcy risk, protecting dividend streams.

Furthermore, dividend growth investing can focus on companies with high dividend growth rates but moderate current yields. For example, Microsoft, which yielded about 1.1% in 2023 but has raised dividends over 20 years consistently, might appeal to investors prioritizing income growth over immediate cash flow.

| Criteria | Ideal Range/Characteristics | Example Company |

|---|---|---|

| Dividend Yield | 2% – 5% | Coca-Cola (3.1%) |

| Payout Ratio | Below 60% | Johnson & Johnson (52%) |

| Consecutive Dividend Growth | 10+ years | Procter & Gamble (65 years) |

| Debt-to-Equity Ratio | Below 1.0 | Microsoft (0.7) |

—

How to Build and Manage a Dividend Portfolio

Building a dividend portfolio begins with defining passive income goals and risk tolerance. A beginner aiming for reliable monthly income might prioritize steady dividend payers with predictable schedules, whereas a long-term investor could emphasize dividend growth for capital appreciation.

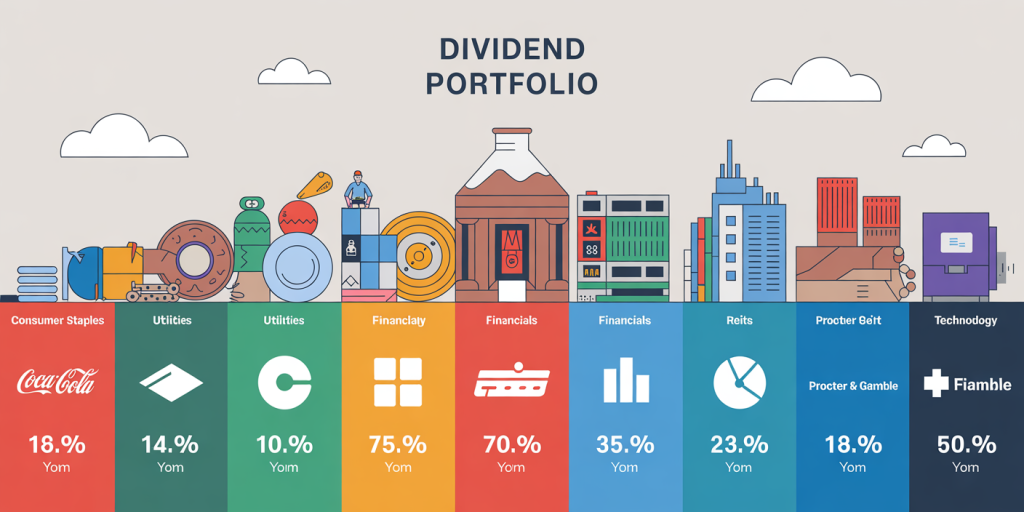

Diversification across sectors is critical to mitigate industry-specific risks. For instance, utilities and consumer staples are traditional dividend stalwarts offering stability. Financials and real estate investment trusts (REITs) often provide higher yields but may carry cyclical risks. Technology companies, while less likely to pay high dividends, can offer growth-oriented income opportunities.

An example portfolio might include: 30% consumer staples (e.g., PepsiCo, Procter & Gamble) 25% utilities (e.g., Duke Energy, Southern Company) 20% financials (e.g., JPMorgan Chase, BlackRock) 15% REITs (e.g., Realty Income) 10% technology dividend growers (e.g., Microsoft)

Regular portfolio reviews are essential to monitor dividend payment consistency and company fundamentals. Dividend cuts or suspensions can signal financial trouble, warranting possible stock replacement.

Dividend reinvestment plans (DRIPs) are another useful tool. Many companies and brokerage platforms offer DRIPs, enabling automatic reinvestment of dividends to purchase additional shares without commission fees. Over time, this accelerates compounding returns, especially valuable for investors not needing immediate income withdrawals.

—

Tax Implications and Dividend Types Investors Should Know

Dividend income is taxable, and understanding tax treatment is vital to maximize after-tax returns. In the United States, dividends are classified as either “qualified” or “non-qualified.” Qualified dividends, which come from domestic companies and certain foreign corporations held for a required period, are taxed at favorable long-term capital gains rates (0%, 15%, or 20% depending on income tax brackets).

Non-qualified dividends, such as those from REITs or certain ETFs, get taxed at ordinary income rates, which can be as high as 37% for top earners. This distinction impacts portfolio construction, as investors in higher tax brackets might prefer qualified dividend stocks to reduce tax burdens.

International investors face different rules depending on countries, treaties, and local regulations. Some nations impose withholding taxes on dividends paid to foreign shareholders, which might reduce net income but can sometimes be reclaimed depending on tax agreements.

Tax-efficient strategies include holding dividend stocks in tax-advantaged accounts, such as IRAs or 401(k)s in the US, to shield dividends from immediate taxation. Additionally, focusing on dividend growth rather than high current yields can defer tax liabilities while growing overall investment value.

—

Comparing Dividend Investing to Other Passive Income Sources

Dividend investing is one of many avenues to generate passive income. Comparing it to other sources highlights its advantages and potential limitations.

| Source | Average Return Range | Risk Level | Liquidity | Tax Considerations |

|---|---|---|---|---|

| Dividend Stocks | 2% – 7% Yield + Capital Gains | Moderate (market risk) | High (public markets) | Qualified dividends taxed favorably |

| Bonds (Corporate/Govt.) | 2% – 5% Yield | Low to Moderate | Moderate to High | Taxed as ordinary income |

| Rental Real Estate | 7% – 10% + Property Value | Moderate to High (tenant, market) | Low | Depreciation benefits; rental income taxed |

| Peer-to-Peer Lending | 5% – 12% | High (default risk) | Low to Moderate | Taxed as ordinary income |

| REITs | 4% – 8% | Moderate (market + sector) | High (public REITs) | Non-qualified dividends generally |

Compared to other sources, dividend investing combines moderate risk with liquidity and tax advantages, making it relatively suitable for beginners. While rental real estate can yield higher returns, it requires active management. Peer-to-peer lending might deliver high yields but with risk of defaults. Bonds provide steady income but often have lower returns and interest rate sensitivity.

—

The Future of Dividend Investing: Trends and Outlook

Looking ahead, dividend investing is poised to evolve in response to economic shifts, technological innovation, and changing corporate policies. With interest rates expected to rise gradually through 2024-2025, dividend stocks could become more appealing relative to fixed income products.

Environmental, Social, and Governance (ESG) criteria are increasingly influencing investment decisions, including dividend stocks. Companies that sustainably balance profitability with responsible practices often maintain better long-term dividend health. For instance, utilities investing in renewable energy may sustain dividends by reducing regulatory risks and operating costs.

Technological innovation is also transforming dividend investing platforms and data analytics. Advanced algorithms help investors identify emerging dividend champions and tailor portfolios dynamically to market conditions. Robo-advisors incorporating dividend-focused strategies further democratize access to this investment style.

Moreover, demographic shifts with aging populations globally suggest that demand for passive income will rise steadily. As baby boomers enter retirement phases, dividend incomes provide an appealing solution for supplementing pensions and social security benefits without aggressive portfolio liquidation.

Data from Morningstar reveals that dividend-paying funds grew assets under management by 15% annually over the past five years, indicating robust investor interest. This growth is expected to continue, driven by the need for both income stability and inflation protection.

In sum, while market volatility and economic uncertainty are eternal risks, dividend investing remains a viable and increasingly sophisticated method for generating passive income. Beginners who grasp its principles, focus on quality stocks, and employ strategic diversification can build portfolios that not only deliver cash flow but also compound wealth over decades.

—

By focusing on stable dividend payers, understanding tax implications, and regularly managing their portfolios, new investors can harness the power of dividend investing to achieve meaningful passive income and long-term financial security. This guide provides a solid foundation to embark on that rewarding journey.