How to Build a Diversified Investment Portfolio from Scratch

Diversification remains one of the fundamental principles of successful investing. Whether you are a novice investor or someone looking to refine an existing portfolio, understanding how to diversify can mitigate risks and optimize returns over the long term. Building a diversified investment portfolio from scratch requires knowledge of asset classes, risk tolerance, financial goals, and strategic asset allocation. This article guides you step-by-step, integrating practical examples, comparative analysis, and current market data to help you construct a balanced and resilient investment portfolio.

Understanding the Importance of Diversification

Diversification is the process of spreading investments across various asset classes and sectors to reduce exposure to any single source of risk. The rationale behind diversification stems from the fact that different types of assets often react differently to market events, economic cycles, and geopolitical factors.

For instance, during the 2008 financial crisis, while stock markets plunged, certain government bonds and gold prices surged, cushioning the impact on diversified portfolios. According to a 2023 survey by Vanguard, well-diversified portfolios delivered 30% less volatility over ten years compared to those concentrated in a single asset class. This statistical evidence underscores the value of integrating diverse investments to ensure steadier returns and lower risk, as opposed to “putting all eggs in one basket.”

Moreover, diversification is not just about risk mitigation but also about capturing growth opportunities across different segments of the market. By investing in stocks, bonds, real estate, and alternative investments, investors can harness the growth potential of each while minimizing the chances that a downturn in one sector severely compromises the overall portfolio.

Assessing Your Financial Goals and Risk Tolerance

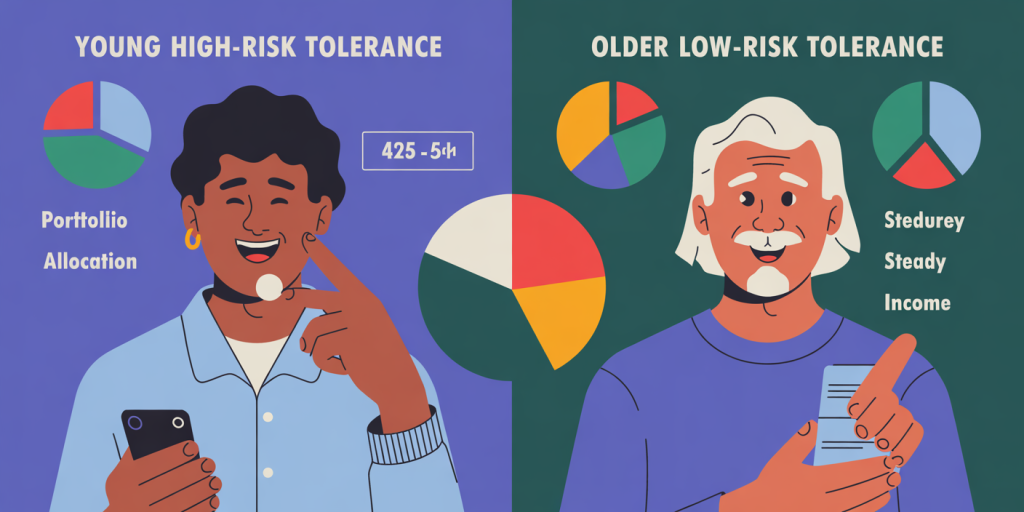

Before selecting assets to diversify your portfolio, it is critical to define your financial goals and evaluate your risk tolerance. Are you saving for retirement 30 years from now, aiming for a down payment on a home in five years, or seeking steady income through dividends? Each goal has distinctive time horizons and risk appetites.

Risk tolerance reflects your emotional and financial capacity to withstand losses. Younger investors with long investment horizons may withstand higher volatility, favoring equities and alternative assets with higher growth potential. Conversely, retirees or conservative investors often prioritize capital preservation and income, tilting toward bonds and stable dividend-paying stocks.

A practical example involves two hypothetical investors, Alice and Bob. Alice is 25 years old and plans to retire at 65; her risk tolerance score, based on a validated questionnaire, falls into the ‘high’ category. Bob, aged 60, seeks to preserve capital and ensure steady income and is categorized as ‘low risk.’ Alice’s portfolio might include 80% equities, 15% bonds, and 5% real estate investment trusts (REITs), whereas Bob’s might lean towards 40% equities, 50% bonds, and 10% cash or money market funds.

Choosing the Core Asset Classes and Allocation

Once you understand your risk tolerance and goals, the next step is to decide which asset classes to include in your portfolio and in what proportions. The most common core asset classes are equities (stocks), fixed income (bonds), cash and equivalents, and alternative investments such as real estate or commodities.

Equities: Growth Engines

Stocks offer ownership stakes in companies and typically provide higher returns over the long run, albeit with greater volatility. Within equities, diversification can be achieved by investing in different sectors (technology, healthcare, consumer goods), company sizes (large-cap, mid-cap, small-cap), and geographic regions (domestic, emerging markets). For example, a US-based investor might allocate 60% of their equity holdings to S&P 500 companies, 25% to international developed markets, and 15% to emerging markets.

Fixed Income: Stability and Income

Bonds are debt instruments that provide interest income and usually carry lower risk than equities. Fixed income assets include government bonds, municipal bonds, corporate bonds, and inflation-protected securities. Diversification in bonds means mixing maturities, credit qualities, and issuers. For instance, including both short-term Treasury bills and longer-term corporate bonds can reduce interest rate risk.

Alternative Investments: Diversifying Beyond Traditional Assets

Alternative assets, such as real estate, commodities, private equity, or hedge funds, can provide uncorrelated returns relative to stocks and bonds. Real estate investment trusts (REITs), for example, often generate steady dividends and perform differently from the equity market. Gold is another classic hedge against inflation and economic uncertainty.

| Asset Class | Expected Annual Return (10-year avg) | Volatility (Standard Deviation) | Typical Role in Portfolio |

|---|---|---|---|

| Equities (Stocks) | 7-10% | 15-20% | Growth and capital appreciation |

| Bonds | 3-5% | 3-7% | Income and risk mitigation |

| Real Estate (REITs) | 8-12% | 12-15% | Income and inflation hedge |

| Commodities (Gold) | 1-4% | 15-25% | Diversification and inflation protection |

(Source: Morningstar, 2024 Market Data)

Balancing these asset classes depends heavily on your risk consensus and investment timeline, but a classic balanced allocation might be a 60/40 split between equities and fixed income.

Practical Steps to Build Your Portfolio

Now that you understand asset classes and allocation, it is crucial to consider practical steps to actually build your portfolio. The first step is selecting the right investment vehicles. For beginners, exchange-traded funds (ETFs) and low-cost index mutual funds offer broad market exposure and automatic diversification within asset classes.

For example, instead of picking individual stocks, you could invest in the Vanguard Total Stock Market ETF (VTI), which holds thousands of US companies. Similarly, the iShares Core U.S. Aggregate Bond ETF (AGG) covers a broad selection of bonds. This approach simplifies diversification and lowers the cost of active management.

Second, consider dollar-cost averaging as a strategy to mitigate timing risk. By investing fixed amounts regularly (monthly or quarterly), you buy more shares when prices are low and fewer when prices rise, thus reducing the impact of market volatility.

Lastly, continually monitor and rebalance your portfolio. Market movements can shift your intended allocation, exposing you to unintended risk levels. Rebalancing involves selling some outperforming assets and buying underperforming ones, keeping the portfolio aligned with your target allocation. For example, if stocks grow to represent 70% of your portfolio instead of 60%, selling some equity holdings and buying bonds might restore balance.

Real-World Example: The Coffee Investor Portfolio

Consider the case of “Coffee Investor,” a hypothetical new investor who wishes to build a $10,000 diversified portfolio with medium risk tolerance and a 15-year investment horizon. After assessing risk and goals, Coffee Investor adopts a 70% equity, 25% fixed income, 5% real estate allocation.

| Asset Class | Allocation | Vehicle | Investment Amount |

|---|---|---|---|

| US Equities | 45% | Vanguard Total Stock Market ETF (VTI) | $4,500 |

| International Equities | 25% | iShares MSCI EAFE ETF (EFA) | $2,500 |

| Bonds | 25% | iShares Core U.S. Aggregate Bond ETF (AGG) | $2,500 |

| REITs | 5% | Vanguard Real Estate ETF (VNQ) | $500 |

By investing in ETFs focusing on broad markets, Coffee Investor achieves instant diversification with a relatively small capital base. This portfolio design balances growth potential with risk control, given Coffee Investor’s medium risk tolerance.

Tracking Performance and Tax Efficiency Considerations

Effective portfolio management requires regular performance reviews. Ideally, you should measure returns relative to benchmarks aligned with your allocation (e.g., compare equities to the S&P 500, bonds to the Bloomberg Barclays Aggregate Bond Index). In addition to absolute returns, monitor metrics such as the Sharpe ratio, which considers risk-adjusted returns.

Another aspect often overlooked is tax efficiency. Holding highly taxed assets in tax-deferred accounts (IRAs, 401(k)s) can improve after-tax returns. For example, bonds and REITs that pay high dividends and interest are better placed in tax-advantaged accounts, whereas equities that generate capital gains can remain in taxable accounts to benefit from lower capital gains tax rates.

Evolving Trends and Future Perspectives in Portfolio Diversification

The future of diversified portfolios is being shaped by technological advancement, evolving markets, and growing interest in sustainable investing. Artificial intelligence (AI)-powered portfolio management tools, often called robo-advisors, now offer automated constructive diversification with algorithms that dynamically adjust allocations based on market conditions and personal risk profiles.

Environmental, social, and governance (ESG) investing is also influencing diversification strategies. Funds focused on ESG criteria tend to tilt investments toward companies with sustainable practices, impacting portfolio construction and risk considerations. According to Morningstar’s 2023 report, ESG funds attracted $51 billion in net new investments globally, suggesting a strong trend toward integrating social impact with financial returns.

Moreover, alternative investments are becoming more accessible to retail investors. Tokenization of real estate and private equity assets through blockchain technology allows smaller investors to diversify beyond traditional stocks and bonds, opening pathways to new growth avenues.

In a globally interconnected economy, diversification must also account for macroeconomic risks such as inflation, geopolitical tensions, and currency fluctuations. Investors might increasingly adopt multi-currency portfolios or hedge currency risks through derivatives.

Above all, diversification remains a dynamic process, requiring periodic reassessment as personal circumstances and market environments evolve. Starting from scratch can be straightforward if approached methodically—understanding your goals, choosing diverse asset classes, employing cost-effective investment vehicles, and adapting to future trends.

—

By following these guidelines, novice investors can build robust, diversified portfolios designed to reduce risk while capturing growth potential — a critical strategy for achieving financial security and wealth accumulation in an unpredictable world.