Financial Freedom vs. Financial Security: What’s the Difference?

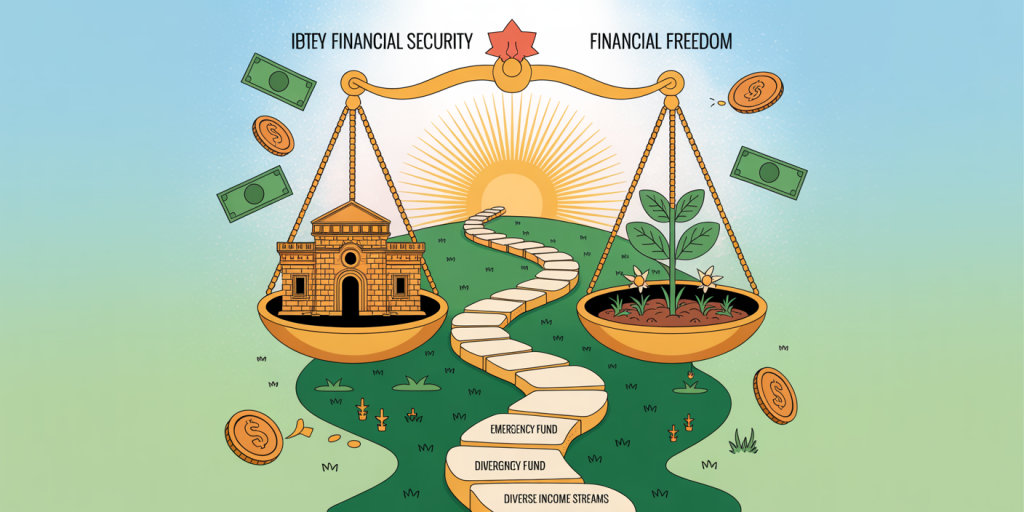

In today’s ever-evolving financial landscape, understanding the nuances between financial freedom and financial security is essential for crafting a well-rounded personal finance strategy. Although these terms are often used interchangeably, they embody distinct financial mindsets and goals, influencing how individuals approach saving, spending, and investing. Distinguishing between the two can empower you to make smarter decisions, align your financial objectives properly, and achieve a more fulfilling economic life.

The concepts of financial freedom and financial security carry different implications based on lifestyle, risk tolerance, and long-term ambitions. This article explores these differences by dissecting each term, providing practical examples, and analyzing data to offer a comprehensive guide on their roles in personal financial planning.

Defining Financial Security: Stability and Peace of Mind

Financial security refers to having a reliable and adequate source of income or resources to cover basic living expenses and unforeseen emergencies. It is about stability—ensuring that day-to-day bills, debts, and necessities like food, shelter, healthcare, and education can be met without undue stress.

For many, financial security means having an emergency fund capable of covering three to six months’ worth of expenses. According to a 2023 survey by Bankrate, approximately 41% of Americans would struggle to cover a $1,000 emergency, highlighting that financial security remains elusive for a large segment of the population. Achieving financial security involves minimizing debt, accumulating savings, and managing expenditures wisely.

Consider the example of Sarah, a middle-income teacher who saves consistently, paying off her debts and maintaining a modest savings account. She has a stable job with benefits and an emergency fund covering six months of expenses. Sarah is financially secure because her basic needs and obligations are reliably covered, even if she faces unexpected costs.

Financial security is also closely linked to risk management. This involves having insurance plans, such as health, disability, and property insurance, that protect against financial setbacks. It often means working steadily without the need to take excessive risks with income, ensuring predictability and continuity.

Understanding Financial Freedom: Independence and Flexibility

Financial freedom expands beyond basic stability, aiming for independence from traditional employment or financial stress. It implies having enough wealth and passive income sources to support desired lifestyles without dependence on active work for survival. This state offers the freedom to pursue passion projects, travel, take sabbaticals, or retire early.

A practical example is John, an entrepreneur who has built an investment portfolio generating significant passive income. John’s dividend payments, rental income, and royalties exceed his living expenses, allowing him to choose whether or not to work. This flexibility defines financial freedom. Unlike Sarah’s financial security, which prioritizes safeguarding against hardship, John prioritizes opportunities and choices supported by diverse income sources.

Recent data supports this movement toward financial freedom aspirations. A 2024 survey by Charles Schwab found that 60% of millennials aim to achieve financial independence by age 40, far earlier than traditional retirement ages. This trend aligns with growing interest in “fire” (financial independence, retire early) communities emphasizing aggressive savings and investing to unlock freedom.

Financial freedom often requires a more aggressive approach—maximizing income streams, optimizing investments, and controlling expenses strategically while taking calculated financial risks. This can involve developing businesses, investing in stocks or real estate, or cultivating digital assets, all aiming to decouple income from time worked.

Key Differences in Goals and Mindsets

The primary difference between financial security and financial freedom lies in their financial goals and underlying mindsets. Financial security focuses on preventing financial hardship and maintaining a sustainable lifestyle, whereas financial freedom centers on expanding life choices through financial means.

| Aspect | Financial Security | Financial Freedom |

|---|---|---|

| Primary Goal | Ensure stability and cover essentials | Achieve independence and flexibility |

| Income | Active income (salary, wages) | Passive income (investments, royalties) and active income |

| Risk Tolerance | Low to moderate | Moderate to high |

| Savings Focus | Emergency funds and debt reduction | Wealth accumulation and growth |

| Work Relationship | Dependence on employment | Optional or no employment required |

| Planning Time Horizon | Short to mid-term (3-10 years) | Mid to long-term (10+ years) |

Financial security is often a prerequisite for financial freedom, providing a stable foundation to take calculated risks. Without this stability, attempting to achieve financial freedom might lead to financial distress due to overexposure to investment risks or income volatility.

Practical Strategies to Achieve Financial Security

Attaining financial security begins with foundational money management:

1. Budgeting and Expense Management: Tracking income and expenses helps identify spending leaks and ensures that necessities are prioritized. For example, Samantha, a single mother, uses a zero-based budget to align her expenses with income and prioritize savings.

2. Debt Reduction: Eliminating high-interest debt such as credit cards stabilizes finances. According to the Federal Reserve, U.S. household credit card debt stood at $930 billion in early 2024, emphasizing the importance of debt control in building security.

3. Emergency Fund Creation: Setting aside three to six months of living expenses provides a buffer against income disruption, job loss, or medical emergencies.

4. Insurance: Adequate health, home, auto, and life insurance can protect against catastrophic financial setbacks.

5. Steady Income Sources: Dependable employment or contracts reduce income unpredictability. This might also include diversifying income through part-time jobs or side hustles for additional security.

Sarah’s case revealed how combining these strategies can cultivate a worry-free financial life. Her secure job means consistent paychecks, and her disciplined saving reduces financial shocks.

Paths to Financial Freedom: Building Wealth and Passive Income

Achieving financial freedom necessitates strategies beyond security, focused on creating wealth and passive income:

1. Investment in Stocks and Bonds: Building a diversified portfolio can generate dividends and capital gains crucial for financial independence. Warren Buffett, for instance, grew wealth primarily through savvy investment, creating substantial passive income streams.

2. Real Estate: Rental properties provide recurring income with potential appreciation. As of 2023, U.S. real estate investors enjoyed an average annual rental yield of approximately 8%, according to Roofstock data, underlining real estate’s role in financial freedom.

3. Entrepreneurship: Starting or acquiring businesses can yield both equity growth and passive revenue streams.

4. Digital Assets and Royalties: With the rise of digital content, creators can generate ongoing income through platforms like YouTube or Patreon.

5. Tax Optimization: Reducing tax liabilities through retirement account planning and deductions helps to accelerate wealth accumulation.

John’s example highlights how establishing varied passive income streams can free individuals from the constraints of traditional employment. His portfolio income outpaces his expenses, allowing discretionary time and lifestyle choices.

The Interplay Between Financial Security and Financial Freedom

While distinct, financial security and financial freedom are interconnected stages on a spectrum: Sequential Progression: Many financial advisors recommend achieving security as the base before expanding wealth toward freedom. A secure financial base reduces risk exposure when pursuing financial freedom. Coexistence: It’s possible to maintain security while pursuing freedom, for example by holding an emergency fund while investing aggressively. Psychological Impact: Financial security provides peace of mind, reducing anxiety about money. Financial freedom enhances life satisfaction by empowering choice. Both contribute significantly to financial well-being.

| Benefit | Financial Security | Financial Freedom | Combined Approach |

|---|---|---|---|

| Emotional State | Reduced anxiety | Increased empowerment | Balanced confidence and excitement |

| Financial Behavior | Conservative spending and saving | Aggressive investing and planning | Disciplined yet growth-oriented |

| Lifestyle Impact | Meets basic needs | Enables desired lifestyle | Stable yet dynamic |

Understanding these dynamics helps individuals tailor financial decisions according to their unique position and aspirations.

Future Perspectives: Trends Shaping Financial Security and Freedom

The future of personal finance is rapidly changing due to technological advancements, economic shifts, and evolving societal norms, influencing how people approach financial security and freedom.

Technological Empowerment: Fintech innovations, automated investing (robo-advisors), and crypto-assets offer new tools for wealth growth and income diversification. These tools democratize financial freedom but also require enhanced financial literacy to avoid new risks.

Gig Economy Impact: As traditional employment models shift, achieving financial security may become more challenging for gig workers due to income volatility and lack of benefits. Simultaneously, the gig economy can serve as a vehicle toward financial freedom for entrepreneurial-minded individuals.

Inflation and Economic Instability: Global inflation trends, with rates averaging 4.9% in 2023 according to the IMF, emphasize the need to protect purchasing power through strategic investing. This urgency pushes even conservatively-minded individuals to seek wealth growth beyond traditional saving.

Sustainability and Ethics: Increasing focus on ESG investments aligns financial freedom goals with social responsibility, shaping new investor behaviors that balance wealth with purpose.

Education and Awareness: Enhanced financial education programs promise improved understanding of both security and freedom pathways, helping individuals avoid common pitfalls such as debt traps or risky speculation.

Embracing these trends will be crucial in navigating personalized financial journeys in coming decades.

Financial freedom and financial security, while distinct, represent complementary dimensions in the pursuit of a prosperous and balanced monetary life. By comprehending their differences and interplay, individuals can adopt tailored strategies that not only safeguard their present but also unlock possibilities for a fulfilling and empowered future.