How Compound Interest Can Turn $100 into $100,000

Compound interest is often hailed as one of the most powerful forces in finance and wealth building. A modest initial investment can grow exponentially over time, thanks to the principle of earning interest not only on the original principal but also on the accumulated interest from previous periods. This phenomenon can transform a seemingly small sum—like $100—into a fortune exceeding $100,000 under the right conditions. Understanding how compound interest works is essential for anyone aiming to grow their savings or investments effectively.

This article delves into the mechanics of compound interest, practical ways to harness it, and the variables that influence its growth. By the end, you’ll see how just $100, when invested wisely and left to compound, can achieve significant wealth over time.

The Basics of Compound Interest: More Than Just Simple Growth

Compound interest differs fundamentally from simple interest. Simple interest is calculated only on the principal amount, whereas compound interest is calculated on the initial principal and also on the accumulated interest from previous periods. This exponential growth is what allows small amounts to balloon significantly over the years.

For example, if you invest $100 at a 5% simple interest rate for 10 years, you would earn $50 in interest, resulting in a total of $150. However, with compound interest at the same rate and period, the total grows to approximately $162.89. This difference might seem modest initially but becomes striking over longer investment horizons and higher interest rates.

The general formula for compound interest is: \[ A = P \left(1 + \frac{r}{n} \right)^{nt} \]

Where: \(A\) = the future value of the investment/loan, including interest \(P\) = the principal investment amount ($100 in our example) \(r\) = annual interest rate (decimal) \(n\) = number of times interest is compounded per year \(t\) = number of years the money is invested or borrowed for

This formula illustrates how increasing \(n\) (compounding frequency) or \(t\) (time) significantly boosts the final amount.

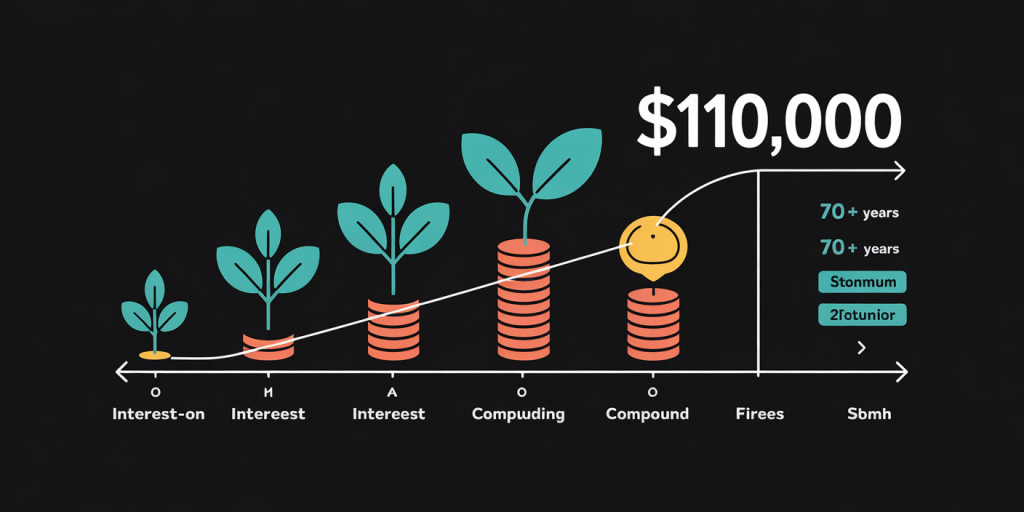

Practical Example: From $100 to $100,000 Over Time

To put compound interest into perspective, consider the following illustration:

If you invest $100 at a 10% annual interest rate compounded yearly, how long will it take to reach $100,000?

Using the compound interest formula, solve for \(t\):

\[ 100,000 = 100 \times (1 + 0.10)^t 1,000 = (1.10)^t \]

Taking the natural logarithm on both sides:

\[ \ln(1,000) = t \times \ln(1.10) t = \frac{\ln(1,000)}{\ln(1.10)} \approx \frac{6.9078}{0.0953} \approx 72.45 \text{ years} \]

Thus, it takes approximately 72.5 years for $100 to grow to $100,000 at 10% interest compounded annually without any additional contributions.

While this duration seems long, increasing either the interest rate or the frequency of compounding reduces the time required. Additionally, making periodic contributions will accelerate the growth substantially.

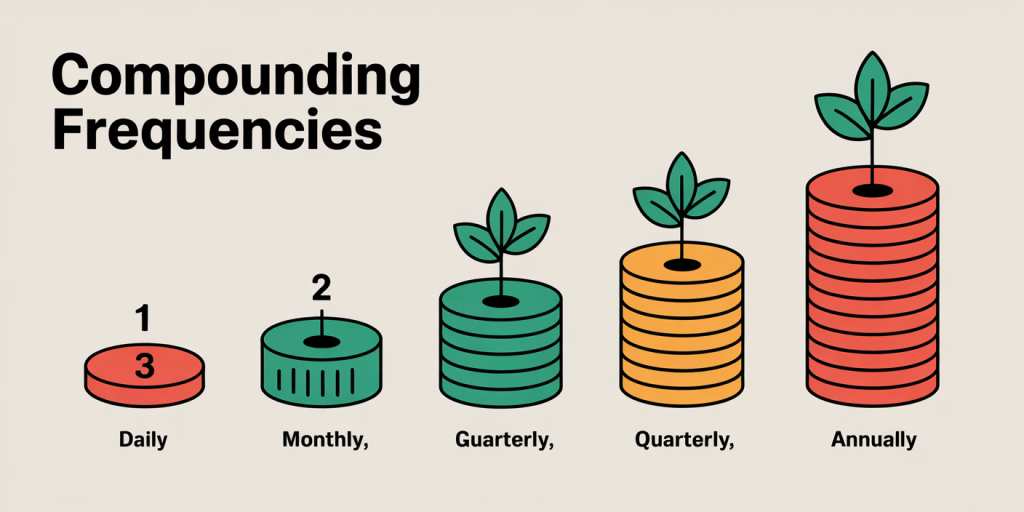

How Compounding Frequency Accelerates Growth

The frequency of compounding—annually, semi-annually, quarterly, monthly, or daily—plays a critical role in how quickly your investment grows. More frequent compounding leads to earning interest on interest more often, slightly boosting the accumulated amount.

Consider the following table comparing $100 compounded at 10% interest over 30 years, varying by compounding frequency:

| Compounding Frequency | Amount After 30 Years |

|---|---|

| Annually | $1,744.94 |

| Semi-Annually | $1,817.44 |

| Quarterly | $1,859.41 |

| Monthly | $1,898.30 |

| Daily | $1,903.66 |

As can be seen, daily compounding yields approximately $158 more than annual compounding after 30 years on just $100. While this may be modest in isolation, when scaled to larger amounts or longer periods, the effect becomes meaningful.

This concept emphasizes the value of investment vehicles that compound frequently, such as certain mutual funds or high-yield savings accounts, compared with simple interest accounts.

Real-Life Case Studies Demonstrating Compound Interest Success

Many famous investors and institutions have used compound interest principles to amass wealth. Warren Buffett, one of the world’s richest people, famously leveraged compound interest by reinvesting gains and maintaining a long-term investment horizon. His early investments, made with relatively small capital compared to his current net worth, have grown exponentially over decades.

Another illustrative case is the famous “Lazy Portfolio.” This strategy, built on low-cost index funds, benefits from regular contributions and compounding over time. For example, starting with $100 and investing $50 monthly into an index fund averaging an 8% annual return, after 30 years, the portfolio would be in the ballpark of $64,000. Increase the contribution or duration, and reaching $100,000 becomes far more feasible.

Similarly, many retirement accounts like 401(k) plans depend fundamentally on compound interest to help workers build large nest eggs with relatively moderate contributions.

The Impact of Periodic Contributions and Inflation

While starting with $100 is a good beginning, adding regular contributions will significantly expedite the journey to $100,000. Using a compound interest calculator, let’s compare scenarios contributing an additional $50 monthly at a 7% annual return:

| Time (Years) | Final Amount Without Contributions | Final Amount With $50 Monthly Contributions |

|---|---|---|

| 20 | $386.97 | $21,794.47 |

| 30 | $1,374.49 | $54,585.45 |

| 40 | $4,801.02 | $120,883.93 |

One can observe that periodic contributions amplify compound interest effects significantly. Over 40 years, an initial $100 grows to only about $4,800 if left alone, but with $50 monthly invested, the total surpasses $120,000.

Inflation, however, erodes purchasing power over time. According to the U.S. Bureau of Labor Statistics, average inflation has hovered around 3% annually over recent decades. This means the real value of $100,000 in 40 years is less than today’s $100,000 due to decreased purchasing power. Nonetheless, opportunities exist—such as investing in equities or inflation-protected securities—to outpace inflation and maintain or increase real wealth.

Comparing Compound Interest Across Investment Vehicles

Not all interest-bearing accounts or investments offer the same rates or compounding frequencies. Here’s a comparative look at typical annual returns and compounding features:

| Investment Type | Average Annual Return | Compounding Frequency | Risk Level |

|---|---|---|---|

| High-Yield Savings Account | 2% – 3% | Daily or Monthly | Low |

| Certificates of Deposit | 2% – 4% | Monthly or Quarterly | Low |

| Government Bonds | 2.5% – 5% | Semi-Annually or Annually | Low to Medium |

| Stock Market Index Funds | 7% – 10% (historical) | Annually or Quarterly | Medium to High |

| Individual Stocks | Variable (avg. ~10%) | Depends on dividends reinvested | High |

By understanding where your money is placed, the interest rate environment, and compounding intervals, you can optimize growth towards your target of $100,000 or beyond. For example, while savings accounts provide safety and liquidity, stock index funds offer higher growth prospects through compound returns, albeit with more volatility.

Planning for the Future: Leveraging Compound Interest Wisely

Looking ahead, compound interest will continue to be a foundational principle for wealth creation in personal finance. The rise of fintech platforms and robo-advisors has democratized access to investments that compound effectively even with small amounts like $100.

Younger investors benefit the most by starting early, capitalizing on decades of compounding. For individuals with irregular income or low initial capital, automated monthly contributions to tax-advantaged accounts such as Roth IRAs or employer-sponsored 401(k)s can multiply the effect of compounding over time.

Moreover, financial education and discipline are crucial. Avoiding unnecessary withdrawals, understanding fees that can erode returns, and continuously monitoring investment performance ensures that compound interest works optimally for your financial goals.

Emerging technologies like blockchain and DeFi (Decentralized Finance) also promise new venues for compounding returns, though with added risks that must be navigated wisely.

—

Compound interest is a remarkable financial tool that empowers individuals to turn modest beginnings into substantial wealth. Though turning $100 into $100,000 requires patience, a reasonable interest rate, and often, regular contributions, the principles behind it are straightforward and backed by decades of empirical evidence.

By understanding compound interest mechanics, selecting appropriate investment vehicles, and maintaining a disciplined savings plan, anyone can harness this powerful force to achieve long-term financial prosperity. The key lies in starting early, staying consistent, and letting interest earn interest for you.