How to Rebalance Your Investment Portfolio Like a Pro

Creating and maintaining a successful investment portfolio requires more than just selecting stocks, bonds, or mutual funds. Over time, market fluctuations, economic changes, and personal financial goals can shift the balance of your investments. This makes portfolio rebalancing a critical strategy to sustain your desired risk level and optimize returns. Professional investors often apply calculated rebalancing strategies, adapting to market trends and personal situations, which is why learning to rebalance like a pro can significantly enhance your investment outcomes.

In this comprehensive article, we will explore the essential mechanics of rebalancing, how to execute it effectively, and the future trends shaping portfolio management. Real examples, comparative tables, and data-driven insights will support your understanding, guiding you to master this vital skill.

Why Portfolio Rebalancing Matters

Portfolio rebalancing is the process of realigning the proportions of assets in your investment portfolio to match your target asset allocation. This is crucial because markets tend to change, causing certain assets to outperform and others to underperform, which skews your original balance.

For example, if your target allocation is 60% stocks and 40% bonds, a surging stock market may increase your stock holding to 70%, exposing you to higher risk than you planned. Without rebalancing, your portfolio becomes more volatile, potentially leading to bigger losses during downturns.

Beyond risk management, rebalancing helps you adhere to your investment strategy, maintain diversification, and capitalize on buying low and selling high. According to Vanguard, portfolios rebalanced annually outperform those left unmanaged by approximately 0.5% per year, which compounds significantly over decades.

Common Rebalancing Strategies Used by Professionals

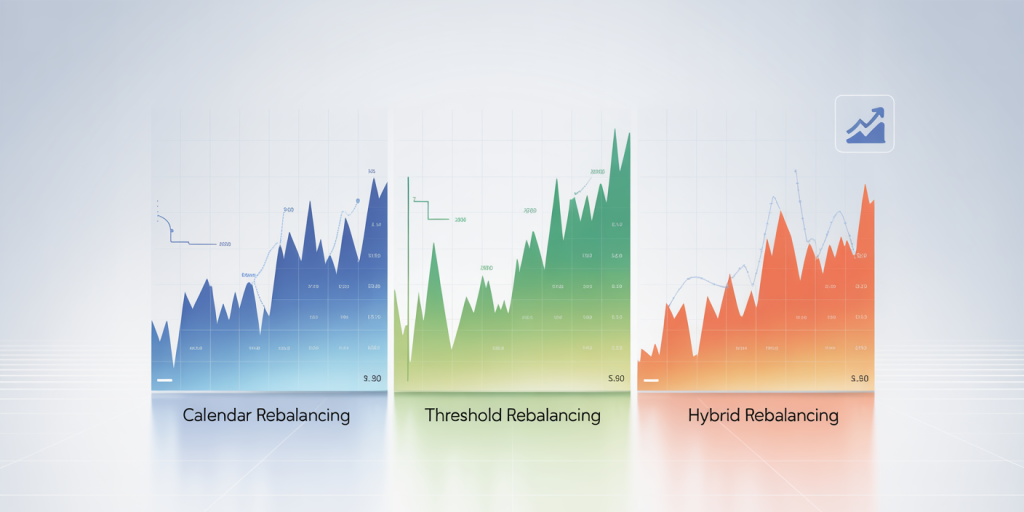

Professional investors employ various rebalancing methods tailored to different financial goals and risk tolerances. The most popular are calendar-based, threshold-based, and hybrid rebalancing.

Calendar-Based Rebalancing

This straightforward approach involves rebalancing at predetermined intervals — quarterly, semi-annually, or annually. It is easy to implement and provides discipline, preventing emotional decision-making. For example, a retiree may choose to rebalance annually to avoid frequent transaction fees while maintaining moderate risk exposure.

However, fixed calendar rebalancing can miss significant market moves if allocations diverge widely between rebalancing dates. For instance, during the volatile market conditions of 2020, investors waiting for an annual rebalance might have held an overly risky portfolio for months.

Threshold-Based Rebalancing

Here, portfolio adjustments occur only when asset allocations exceed specified thresholds. For example, rebalancing is triggered if stocks deviate more than 5% from their target weight. This dynamic approach can be more responsive but requires frequent monitoring.

A study by Morningstar showed that threshold-based rebalancing can reduce portfolio volatility by 7%-10% compared to calendar rebalancing while improving risk-adjusted returns by approximately 0.3% annually. However, threshold strategies may lead to more frequent trades, increasing tax implications.

Hybrid Rebalancing

Hybrid strategies balance the pros and cons of calendar and threshold approaches. Investors might check allocations quarterly, rebalancing only if deviations exceed 5%. This method reduces unnecessary trades while managing risk effectively.

For instance, BlackRock utilized hybrid rebalancing in their multi-asset funds, reporting improved Sharpe ratios over pure calendar rebalancing during 2015-2020, indicating better risk-adjusted performance.

| Strategy | Frequency | Pros | Cons | Typical Use Case |

|---|---|---|---|---|

| Calendar-Based | Fixed intervals (e.g., annually) | Simple, disciplined | May miss risk spikes | Conservative investors |

| Threshold-Based | When asset deviates by set % | Responsive to market changes | Potentially higher trading costs | Active investors |

| Hybrid | Combo of both | Balanced approach | Requires monitoring | Professional managers |

Step-by-Step Guide to Rebalance Your Portfolio

Whether you are an individual investor or a financial advisor, following systematic steps can help rebalance portfolios proficiently.

Step 1: Define Your Target Allocation

Begin with establishing clear asset allocation aligned with your risk tolerance, financial goals, and investment horizon. This might be 70% stocks and 30% bonds for a growth-focused portfolio or 40% stocks and 60% bonds for conservative investors.

Detailed questionnaires, risk profiling tools, or consultations with financial planners can assist with this crucial step.

Step 2: Assess Your Current Portfolio

Gather up-to-date information about your current holdings, including market values and asset categories. Tools like Personal Capital or Fidelity’s portfolio tracker provide real-time insights.

Calculate the current composition as a percentage of total portfolio value. For example, if stocks now constitute 65% instead of 60%, you know rebalancing is due.

Step 3: Calculate Rebalancing Needs

Use simple formulas to determine how much to buy or sell of each asset. For instance:

> Amount to trade = Current allocation (%) – Target allocation (%) × Total portfolio value

If your portfolio is worth $100,000, and stocks have risen to 65%, but your target is 60%, you need to sell:

> (65% – 60%) × $100,000 = $5,000 in stocks.

Step 4: Execute Trades Strategically

Selling high and buying low is the programmer’s mantra in rebalancing. Use limit orders when necessary and consider tax implications. For taxable accounts, sell losing positions first to realize tax benefits.

Some portfolios can rebalance through new contributions or dividends, reducing trading costs. For example, if you expect a $10,000 contribution, allocate it more to bonds if stocks are overweight.

Step 5: Monitor and Document

Keep detailed records of your rebalancing transactions for performance review and tax reporting. Set alerts or use rebalance calculators to automate future steps.

Tax and Transaction Cost Considerations

Rebalancing often involves buying and selling securities, which trigger transaction costs and potential tax liabilities. Professional investors use tactics to minimize these expenses.

Strategies to Mitigate Tax Impact

Tax-efficient rebalancing can save investors significant money. For example, tax-loss harvesting — selling investments at a loss to offset gains — can be synced with rebalancing actions.

A 2019 report by the National Bureau of Economic Research found that incorporating tax-loss harvesting during rebalancing boosted after-tax returns by up to 0.7% annually for taxable accounts.

Minimizing Transaction Fees

Using no-commission ETFs or mutual funds is a popular way to keep costs low. Furthermore, rebalancing with new deposits or dividends often reduces the need for selling and buying.

Example: Fidelity offers zero-commission trades on many ETFs, helping investors rebalance portfolios frequently without eroding returns.

Case Study: Rebalancing During Market Volatility

The COVID-19 pandemic-induced market crash in March 2020 offers a powerful example of rebalancing in action. Consider a portfolio originally balanced with 60% stocks and 40% bonds.

When stocks plunged by 30% in weeks, this allocation shifted to approximately 45% stocks and 55% bonds. Investors sticking to calendar-based rebalancing had to wait months before making adjustments, missing opportunities to buy stocks at lower prices.

Conversely, threshold-based rebalancers triggered rebalancing within days, increasing stock exposure, which rewarded them as the market rebounded by over 50% in the subsequent year.

This example highlights the benefit of responsiveness combined with strategic patience—a hallmark of professional rebalancing.

Future Perspectives in Portfolio Rebalancing

Technological advancements and data analytics are transforming portfolio rebalancing into a more precise and automated practice. Artificial intelligence (AI) and machine learning algorithms now analyze vast datasets to optimize rebalancing schedules personalized to investor behavior and market trends.

Robo-advisors like Betterment and Wealthfront have integrated dynamic rebalancing features, adjusting asset weights based on automated risk assessment and tax efficiency in real-time. According to a 2022 report by Deloitte, robo-advisors have grown by 25% annually in assets under management, emphasizing the trend toward tech-enabled professional portfolio management.

Additionally, environmental, social, and governance (ESG) factors are reshaping asset allocation priorities. Rebalancing models now incorporate sustainability scores alongside traditional financial metrics, pushing portfolios toward socially responsible investing.

Investors should expect more sophisticated tools, including predictive analytics and scenario simulations, enabling proactive rather than reactive rebalancing. This evolution promises enhanced portfolio resilience and returns.

Mastering portfolio rebalancing like a professional involves understanding your risk profile, selecting the right strategy, executing with discipline, and leveraging technology smartly. With these insights, you can maintain asset allocation integrity and achieve consistent long-term growth regardless of market conditions.