How to Start Investing for Your Kids’ Future

Planning for your children’s financial future is one of the most important responsibilities of parenthood. Establishing a solid investment strategy early on can provide your kids with the resources they need for education, buying a first home, or even launching a business. This article explores practical steps and effective investment options tailored to secure a prosperous financial foundation for your children.

Understanding the Importance of Early Investing for Kids

Starting to invest for your kids at an early stage can significantly benefit from the power of compounding. Compounding allows earnings on an investment to generate their own earnings, speeding up wealth accumulation over time. According to a 2023 study by Fidelity Investments, accounts opened for children before the age of five tend to accumulate 2-3 times more wealth by the time the child reaches 18 than accounts opened later.

Consider the case of Sarah, a 30-year-old mother who began investing $200 monthly in a diversified index fund for her newborn daughter. By the time her daughter turns 18, assuming an average annual return of 7%, the investment would grow to approximately $56,000, enough to cover significant parts of college tuition or a down payment on a house.

However, it’s not only about money. Early investments teach children the value of saving and financial planning, forming habits that lead to long-term financial independence. By involving kids in the process, parents can cultivate financial literacy from a young age.

Choosing the Right Investment Vehicle for Your Children’s Needs

There are various investment options available for parents, each with its advantages and limitations. The choice largely depends on your financial goals, risk tolerance, and the time horizon.

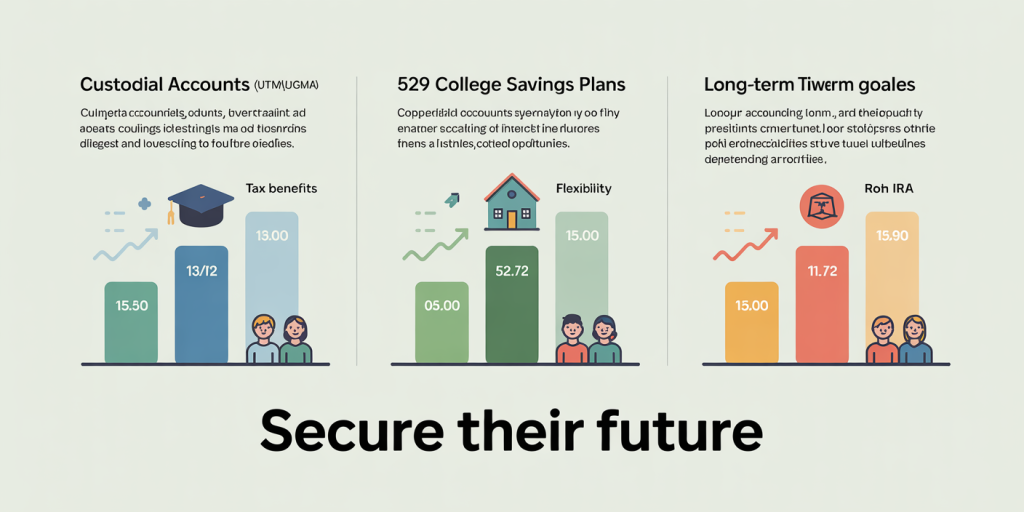

1. Custodial Accounts (UTMA/UGMA)

Uniform Transfers to Minors Act (UTMA) and Uniform Gifts to Minors Act (UGMA) accounts are popular vehicles allowing parents to invest on behalf of their children until they reach legal adulthood. Money invested in these accounts can be used for any purpose benefiting the child, not just education.

Advantages: Flexibility in withdrawals Wide range of investment options (stocks, bonds, mutual funds)

Disadvantages: Gains are taxed, which could impact growth Once the child reaches majority age, they gain full control over the account, which might not align with parental intentions

2. 529 College Savings Plans

529 plans are tax-advantaged savings plans designed to encourage saving for future education costs. Contributions are not federally tax-deductible, but earnings grow tax-free, and withdrawals for qualified educational expenses are exempt from federal income tax.

Advantages: Tax benefits specifically for education-related expenses High contribution limits

Disadvantages: Limited to educational expenses (college tuition, room and board, etc.) Penalties for non-qualified withdrawals

3. Roth IRAs for Kids

While primarily retirement vehicles, Roth IRAs can be opened for minors who have earned income. The advantage is that funds grow tax-free and can be withdrawn tax-free for qualified expenses, including a first-time home purchase.

Advantages: Tax-free growth and withdrawals Funds can be used flexibly after age 59½ or for certain exceptions earlier

Disadvantages: Requires the child to have earned income Contribution limits ($6,500 in 2024) may restrict investment size

The following table summarizes key differences:

| Investment Type | Tax Benefits | Flexibility | Contribution Limits (2024) | Ideal Purpose |

|---|---|---|---|---|

| Custodial Accounts (UTMA/UGMA) | No tax benefits on contributions; capital gains taxed | High (any use) | No formal limit | General savings/goals |

| 529 College Savings Plan | Tax-free growth and withdrawals for education | Medium (education-only) | No limit (varies by state) | College expenses |

| Roth IRA for Kids | Tax-free growth and withdrawals; contribution limit | High (retirement plus exceptions) | $6,500 per year | Long-term saving, retirement, home purchase |

Setting Realistic Goals and Time Horizons

Before investing, parents should clearly define their financial goals related to their children’s future. Not all goals are equal; saving for college is a relatively short- to mid-term goal, whereas building wealth for retirement or a business launch could be longer-term.

For example, if your child is a newborn, you have 18 years to grow the investment, which allows you to take more risk with equities or index funds. Conversely, if your child is 12 and you need to fund college in six years, safer investments such as bonds or balanced funds may be more appropriate.

Behavioral economist Dr. Anuj Shah suggests that goal-specific investing enhances commitment and adherence to financial plans. Practical advice is to create multiple “buckets” with tailored risk levels: a high-growth bucket for long-term needs and a conservative bucket for near-term expenses.

Building a Diversified Investment Portfolio

Diversification is key to managing risk in investing. A well-balanced portfolio includes a mix of asset classes like stocks, bonds, and cash equivalents. For children’s investments, the level and type of diversification should match the time horizon and risk tolerance.

Historically, the S&P 500 index has returned approximately 10% annually over the last 90 years but with significant volatility in the short term. In contrast, government bonds typically return around 2-3% with lower risk. Combining these can smooth returns and protect capital.

Practical example: For an 18-year investment horizon, a simple portfolio might consist of 80% equities (index funds or ETFs) and 20% bonds initially. As the child approaches college age, the portfolio can gradually shift toward a more conservative 40/60 split to preserve capital.

According to Vanguard’s 2023 report, portfolios tilted toward equities outperform mixed portfolios over 10+ year periods, but with higher short-term drawdowns. Managing this balance is essential for achieving long-term growth while preserving funds for targeted expenses.

Leveraging Automated Plans and Financial Technology

Automated investment platforms, commonly known as robo-advisors, offer user-friendly tools to manage kids’ investments without requiring extensive financial expertise. These platforms use algorithms to adjust portfolios based on age, risk preferences, and goals.

Examples include Betterment, Wealthfront, and Fidelity Go. Many of these services offer custodial accounts with low fees and automatic rebalancing, which optimizes the investment experience for busy parents.

Practical use case: John, a working father, chose Wealthfront’s 529 plan for his daughter. With automatic contributions set monthly, the portfolio adjusts asset allocations yearly to reduce risk as his daughter gets closer to college age—all without manual intervention.

Such technology enhances financial discipline and reduces emotional investment decisions, increasing the likelihood of success.

Future Perspectives: Preparing Kids for Financial Independence

Investment is only one part of preparing your children for financial independence. Educating them about money management, including budgeting, saving, and investing, equips them to handle finances responsibly as they mature.

Programs like the National Endowment for Financial Education (NEFE) suggest integrating practical financial education at home, such as involving children in household budgeting or explaining how investments grow over time.

Looking ahead, new trends like the rise of Environmental, Social, and Governance (ESG) investing enable families to align investments with ethical values, potentially nurturing a socially conscious mindset in children.

Additionally, the increasing accessibility of cryptocurrencies and digital assets introduces both opportunities and risks. Parents should carefully evaluate these options before incorporating them into kids’ investment portfolios.

In the long term, combining smart investment strategies with continuous financial education creates a sustainable path to economic security, empowering the next generation to thrive independently.

By starting early, choosing suitable investments, diversifying wisely, leveraging technology, and fostering financial knowledge, parents can effectively secure their children’s financial futures. Making informed investment decisions today paves the way for greater opportunities and lasting success for the generations to come.