Stock Market for Beginners: A Friendly Guide to Getting Started

Stepping into the world of investing can seem daunting, especially for beginners who might find the stock market complex and intimidating. However, understanding the fundamentals of the stock market is crucial for anyone looking to grow their financial portfolio over time. With the right knowledge, beginner investors can make informed decisions, avoid common pitfalls, and harness opportunities that the stock market offers. This guide aims to simplify stock market concepts, supported by practical examples and real-world cases, so you can embark on your investing journey with confidence.

The global stock market, according to the World Federation of Exchanges, had a market capitalization exceeding $130 trillion in 2023, signaling its immense role in wealth creation worldwide. From individual investors buying shares of tech giants such as Apple or emerging companies listed on NASDAQ, the stock market enables access to partial ownership of businesses. This article will break down essential topics such as stock types, investment strategies, risks, and critical practical tips to help beginners start effectively.

Understanding Stocks and How They Work

At its core, a stock represents a share of ownership in a company. When you purchase stock, you essentially buy a slice of that business, entitling you to a portion of its profits — often in the form of dividends — and voting rights in shareholder meetings. Stocks are traded on stock exchanges like the New York Stock Exchange (NYSE) or NASDAQ, where buyers and sellers interact to determine the stock price based on supply and demand.

For example, if you buy 10 shares of a company like Microsoft at $280 per share, your total investment equals $2,800. If Microsoft performs well and the share price rises to $350, your investment value increases to $3,500, netting an unrealized gain of $700. This potential for capital appreciation makes stocks attractive to investors looking for growth opportunities.

Types of stocks vary primarily between common and preferred stocks. Common stocks give shareholders voting rights and potential dividends, but dividends are not guaranteed and can fluctuate. Preferred stocks typically offer fixed dividends but do not afford voting rights. For beginners, investing in common stocks is generally more accessible and aligns with most growth-focused strategies. It’s important to understand these distinctions to choose investments that match your financial goals.

Various Investment Strategies for Newcomers

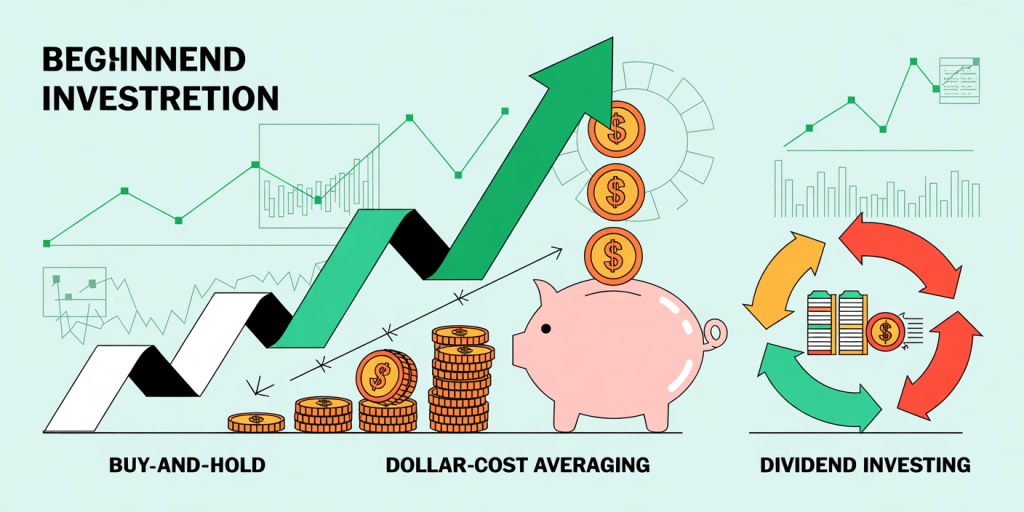

Choosing an investment strategy is vital in the stock market because it influences your risk tolerance, investment horizon, and portfolio composition. Three popular strategies for beginners include buy-and-hold investing, dollar-cost averaging, and dividend investing.

Buy-and-Hold Investing involves purchasing stocks and holding them for an extended period regardless of market volatility. This approach banks on the market’s general upward trend over time. For example, investors who held shares of Amazon from its IPO in 1997 to present have experienced phenomenal growth despite periodic downturns. Data shows the S&P 500 index, representing 500 large U.S. companies, has returned an average of 10-11% annually over the past 90 years, reinforcing the wisdom of long-term holding.

| Strategy | Description | Suitable For | Pros | Cons |

|---|---|---|---|---|

| Buy-and-Hold | Purchase and hold stocks long-term | Long-term investors | Lower transaction fees; tax benefits | Cannot avoid short-term crashes |

| Dollar-Cost Averaging | Invest fixed amount regularly regardless of price | Risk-averse beginners | Reduces timing risk | May miss buying opportunities |

| Dividend Investing | Focus on stocks with regular dividend payments | Income-focused investors | Steady income; reinvestment potential | Dividends subject to cuts |

Dollar-Cost Averaging (DCA) involves investing a fixed amount of money at regular intervals, such as monthly, regardless of market conditions. This strategy is helpful for beginners who want to mitigate the risk of buying at market peaks. By investing consistently, you purchase more shares when prices are low and fewer when prices are high, averaging the purchase cost over time.

Dividend Investing appeals to those seeking regular income from their investments. Companies such as Coca-Cola and Johnson & Johnson have a strong history of paying reliable dividends. Reinvesting dividends can further compound your returns, creating a powerful wealth-building tool.

Managing Risks in Stock Market Investing

Risk management is crucial for new investors to preserve capital and avoid panic-selling during market downturns. The stock market can be volatile, affected by factors such as economic shifts, geopolitical events, or company-specific news.

A practical example involves the 2008 financial crisis when the global stock market lost nearly 40% in value. Investors who panicked and sold their holdings faced realized heavy losses, while those who stayed invested or gradually added shares during the slump saw significant recoveries in the following years.

Diversification is a key strategy to manage risk by spreading investments across various stocks, sectors, or asset classes. For instance, instead of investing all $10,000 in technology stocks, a diversified portfolio could allocate funds to technology, healthcare, utilities, and consumer goods. This approach reduces the impact of poor performance in any single sector.

| Risk Type | Description | Mitigation Strategies |

|---|---|---|

| Market Risk | Fluctuations due to economic or political factors | Diversification, hedging |

| Company-Specific Risk | Poor business performance or scandals | Research, investing in multiple companies |

| Liquidity Risk | Inability to sell stocks quickly without price drops | Invest in high-volume stocks |

| Inflation Risk | Reduced purchasing power over time | Investing in growth stocks or inflation-protected securities |

Furthermore, using stop-loss orders, where you set a predetermined price to sell a stock, can help limit losses. Beginners should also set realistic expectations and avoid investing money needed for short-term expenses.

Essential Tools and Resources for Beginners

Access to reliable tools and information is vital to making smart investment decisions. Online platforms such as Robinhood, E*TRADE, and Fidelity provide intuitive interfaces for buying and selling stocks and offer educational materials tailored for beginners.

Understanding financial statements, such as balance sheets, income statements, and cash flow reports, helps in analyzing a company’s health. For instance, looking at Amazon’s annual report provides insights into its revenue growth, profit margins, and debt levels.

News sources like Bloomberg, CNBC, and Reuters keep investors updated on market trends. Additionally, stock screeners allow investors to filter companies based on criteria like market capitalization, dividend yield, or price-to-earnings ratio. Apps like Yahoo Finance and Seeking Alpha offer aggregated data and expert commentary.

Here’s a comparative table of popular brokerage platforms for beginners:

| Platform | Minimum Deposit | Commission Fees | Educational Resources | Mobile App Quality |

|---|---|---|---|---|

| Robinhood | $0 | $0 | Basic | Excellent |

| E*TRADE | $500 | $0 | Extensive | Very Good |

| Fidelity | $0 | $0 | Comprehensive | Excellent |

| Charles Schwab | $0 | $0 | Advanced | Very Good |

These platforms reduce barriers to entry by minimizing costs and providing easy-to-use interfaces and resources for learning.

Practical Steps to Get Started with Investing

Once you understand the basics and have a strategy, the next step is to open a brokerage account. Choose one that fits your budget and preferences, such as low fees and user-friendly tools. After funding your account, start small. For example, you could begin by investing $100 in an Exchange-Traded Fund (ETF) like the SPDR S&P 500 ETF (ticker: SPY), which tracks the performance of 500 large companies instead of buying single stocks.

Begin with paper trading or simulated accounts, offered on platforms such as Investopedia Stock Simulator, to practice without risking real money. This builds confidence and familiarity with order types, portfolio tracking, and market movements.

Setting clear goals is essential — whether it’s saving for retirement or generating supplementary income. For instance, if your goal is long-term growth, focusing on index funds or blue-chip stocks is advisable. For shorter horizons, more conservative investments or bonds may suit better.

Develop a habit of reviewing your portfolio quarterly to rebalance holdings and adjust your investment mix as needed. Always continue educating yourself about market trends, economic indicators, and company performance to make timely decisions.

Looking Ahead: The Future of Stock Market Investing for Beginners

The stock market continues to evolve with advancements in technology, regulatory changes, and shifting investor demographics, presenting new opportunities and challenges for beginners.

For example, the rise of fractional shares enables investors to purchase a portion of a stock, making high-priced stocks like Tesla or Alphabet more accessible. Robo-advisors like Betterment or Wealthfront are gaining popularity by providing automated, algorithm-driven portfolio management with minimal fees, ideal for novice investors seeking hands-off strategies.

Moreover, environmental, social, and governance (ESG) investing is becoming mainstream as investors increasingly seek companies that align with their values. According to Morningstar, global sustainable fund assets reached $3 trillion in 2023, offering beginners themes and funds focused on sustainability.

Artificial Intelligence and machine learning tools are also being integrated into trading and analysis platforms, improving stock screening and risk assessment capabilities. As financial literacy improves worldwide, more people are empowered to participate in the markets, fostering a more inclusive investment environment.

However, it’s critical for beginners to remain cautious of hype and speculative bubbles. The pandemic-induced mania around certain stocks and cryptocurrencies serves as a reminder that discipline, patience, and continuous learning are key to investment success.

Final Thoughts for Aspiring Investors

Starting in the stock market doesn’t require an advanced degree or millions of dollars. By learning foundational concepts, selecting suitable strategies, using reputable tools, and managing risk prudently, beginners can build robust portfolios and achieve their financial goals.

Remember, investing is a marathon, not a sprint. Steady, informed, and consistent actions laid down today can lead to meaningful wealth accumulation tomorrow. The key is to start early, stay committed, and keep growing your understanding of this fascinating world of stocks.