The Rule of 72: How Fast Will Your Investment Double?

When it comes to investing, one of the simplest but most powerful concepts investors use to estimate growth is the Rule of 72. This handy mathematical shortcut helps determine how long it will take for an investment to double in value given a fixed annual return. Whether you’re a beginner trying to understand the dynamics of compound interest or an experienced investor assessing various opportunities, the Rule of 72 offers immediate insight into the potential of your money.

Understanding how fast your investment doubles enables better financial planning, portfolio management, and goal-setting. It also illuminates the critical impact of interest rates and return periods on wealth accrual. In the following sections, we will explore the mechanics behind the Rule of 72, practical application examples, a comparative analysis with other financial formulas, and future outlooks on investment growth in various economic climates.

Understanding the Rule of 72

The Rule of 72 is a simple formula used to estimate the number of years required to double an investment’s value based on a fixed annual interest rate. The calculation divides 72 by the annual rate of return to get an approximate doubling time.

\[ \text{Doubling Time (years)} = \frac{72}{\text{Annual Rate of Return (\%)}} \]

This rule serves as an approximation of the logarithmic formula for compound interest but is much easier to calculate mentally. For example, if an investment grows at 6% per year, dividing 72 by 6 gives 12 years to double the principal.

The Rule of 72 assumes the rate of return is compounded annually and remains constant over the period, which simplifies real-world complexities but functions well as a back-of-the-envelope estimator. It highlights the magic of compound interest by showing how even modest returns can lead to significant growth over time.

This formula has been widely used since the Renaissance, attributed to various mathematicians like Leonardo Fibonacci, appreciating its blend of mathematical convenience and financial insight. Despite its simplicity, it demonstrates foundational principles of exponential growth relevant across economics and personal finance.

Practical Examples of the Rule of 72 in Action

Consider an investor who has $10,000 and wants to understand how long it will take to double the investment at various fixed annual returns. Using the Rule of 72, the investor can quickly see these estimations:

| Annual Return (%) | Years to Double (72 / Return) |

|---|---|

| 4 | 18 |

| 6 | 12 |

| 8 | 9 |

| 12 | 6 |

| 18 | 4 |

For example, with an 8% annual return from a diversified stock portfolio, the investor can expect their money to double in roughly 9 years. If instead, they choose a safer government bond offering a 4% yield, it will take about 18 years to achieve the same result.

Real-world cases underline how this rule helps in setting realistic goals. Warren Buffett’s long-term portfolio has averaged around 20% annual returns, meaning his investments doubled roughly every 3.6 years—a pace that accelerated wealth creation and allowed him to amass one of the largest fortunes worldwide.

Comparing the Rule of 72 with Exact Compound Interest Calculations

While the Rule of 72 is a quick heuristic, actual compound-interest calculations provide precise doubling times. The compound interest formula for doubling is:

\[ 2 = (1 + r)^t \implies t = \frac{\ln(2)}{\ln(1 + r)} \]

Where: \( t \) = number of years to double \( r \) = annual interest rate (decimal) \( \ln \) = natural logarithm

To contrast, let’s compare doubling times for several rates calculated using both methods:

| Annual Return (%) | Rule of 72 (Years) | Exact Compound Interest (Years) | Difference (Years) |

|---|---|---|---|

| 4 | 18 | 17.67 | +0.33 |

| 6 | 12 | 11.90 | +0.10 |

| 8 | 9 | 9.01 | -0.01 |

| 12 | 6 | 6.12 | -0.12 |

| 20 | 3.6 | 3.80 | -0.20 |

The Rule of 72 provides a close approximation, especially in the range of 6-10% returns, which mirrors many stock market averages. The slight variance at very high or very low returns can be adjusted using modifications such as the Rule of 69.3 (natural logarithm of 2 multiplied by 100) for more precision.

For practical investing, this difference is often negligible, but understanding it can help in financial modeling and accurate forecasting.

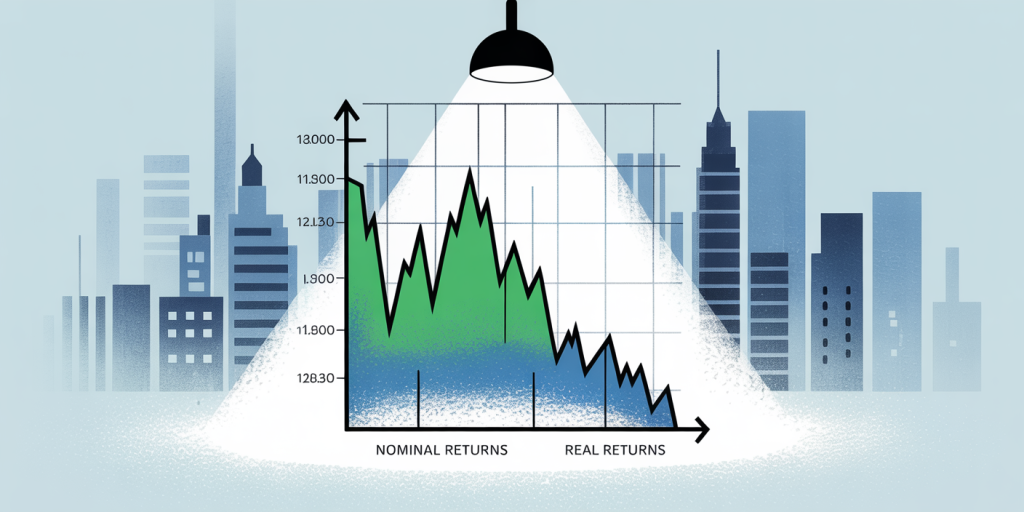

The Impact of Inflation on Investment Doubling

While the Rule of 72 gauges nominal returns, inflation affects the real growth of your investment’s purchasing power. Even if your portfolio doubles nominally, rising prices may erode the value of your gains.

To account for inflation, adjust the nominal rate using the formula:

\[ \text{Real Return} = \frac{1 + \text{Nominal Return}}{1 + \text{Inflation Rate}} – 1 \]

For example, if your investment yields 8% nominally but inflation is at 3%, the real return is approximately 4.85%:

\[ \frac{1 + 0.08}{1 + 0.03} – 1 = \frac{1.08}{1.03} – 1 = 0.0485 = 4.85\% \]

Using the Rule of 72 to estimate real doubling time:

\[ 72 / 4.85 \approx 14.8 \text{ years} \]

This means you need nearly 15 years to double your investment in real terms, substantially longer than the nominal 9 years calculated for an 8% return.

According to U.S. Bureau of Labor Statistics data, the average annual inflation rate over the past 30 years has been about 2.5%. Factoring this into investment planning is critical for retirees and long-term savers to preserve their purchasing power.

Strategic Applications of the Rule of 72 in Portfolio Management

The Rule of 72 is particularly useful in comparative investment analysis. For example, choosing between a savings account at 1.5% interest versus an index fund averaging 7% annually can impact your time horizon for wealth accumulation.

By calculating the doubling times:

| Investment Type | Annual Return (%) | Doubling Time (Years) |

|---|---|---|

| High-yield savings account | 1.5 | 48 |

| Corporate bonds | 4 | 18 |

| Stock market index fund | 7 | 10.3 |

| Cryptocurrency (volatile) | 20 (hypothetical) | 3.6 |

While high returns may be appealing, higher yields often accompany increased volatility and risk. Understanding how quickly your money grows helps balance risk vs reward over your investment horizon.

Wealth-building strategies like dollar-cost averaging also align with this principle. Regular contributions can exponentially grow your portfolio, particularly when returns consistently compound, shortening the time it takes to double your investment base.

Future Perspectives: The Rule of 72 Amidst Changing Economic Trends

Looking ahead, economic dynamics such as fluctuating interest rates, inflation, and evolving market conditions influence investment doubling times.

The current low-interest-rate environment globally means traditional savings vehicles yield modest returns, extending doubling timelines. For instance, a 1% savings account requires roughly 72 years to double money, pushing investors toward equities, real estate, or alternative assets.

Meanwhile, post-pandemic inflationary pressures have increased real return challenges. Central banks’ monetary policies will play a crucial role in shaping investment landscapes, affecting how applicable the Rule of 72 remains practically.

Technological advancements and financial innovation are also creating more diversified investment opportunities, with variable returns ranging widely. Robo-advisors, ESG funds, and digital assets provide choices that could either accelerate or slow down wealth doubling based on risk appetite and market cycles.

In this evolving future, the Rule of 72 remains a foundational tool, but investors should complement it with comprehensive analysis including inflation adjustments, risk considerations, and personalized goals.

By understanding and applying the Rule of 72, investors can efficiently gauge the growth pace of their portfolios and make informed decisions under varying financial scenarios. Its enduring simplicity combined with practical relevance ensures its place in effective investment education and strategy formulation.